Accounting Statistics & Facts

Accountants and auditors are an essential part of every business. These professionals make sure your numbers add up, perform audits, and run payroll. While the importance of accounting has always been the same, the job itself has changed over the years. So has demand. Scroll down and find the critical accounting statistics everyone should know this year, including accounting employment rate and job outlook.

Accounting Statistics (Editor’s Choice)

- The median annual salary for accountants and auditors in the USA was $77,250 in 2021. (BLS)

- By 2022, the global accounting services market value is expected to reach $868 billion. (The Business Research Company)

- About 79% of accounting firms offer booking/accounting services to their clients. (Sage Practice of Now 2019)

- By 2026, the global accounting software market is forecasted to hit $20 million. (Fortune Business Insights)

- Cloud accounting is used by 82% of small businesses and 58% of enterprises. (Viewpost)

- The cloud accounting market could reach $4.25 billion by 2023. (Flexi)

General Accounting Stats

1. The global accounting services market value is projected to reach $868 billion by 2022.

Increased mergers, standards transition, and technology stocks performance are some of the reasons for the steady global accounting field growth. By 2022, The Business Research Company forecasts a CAGR increase of 9.1% to $868 billion. They also highlight a few factors that may slow down the pace of the industry. Some of these include insignificant wage growth, inconsistency in delivery, and scandals.

(The Business Research Company)

2. 82% of accountants say companies are more demanding these days.

Based on Sage accounting stats, most accounting professionals admitted that clients are more demanding when it comes to the accounting job requirements than they were in the past. 87% agree that clients expect more flexibility and better service levels from accountants, without an increase in their rates.

(Sage Practice of Now 2020)

3. Booking/accounting is the top service performed by accounting firms with 79%.

The Sage 2019 accounting industry statistics reveal that accounting is followed by payroll (25%), tax (24%), and compliance (20%). Other services accountants and accounting firms undertake are business advisory (17%), audit/assurance (15%), and outsourced CFO (5%).

(Sage Practice of Now 2019)

4. In 2020, there were 1.27 million accountants and auditors in the United States.

Even more jobs, according to Statista’s report, are held by bookkeeping, auditing, and accounting clerks. More precisely, about 1.44 million positions in the US belonged to employees in this category, according to accounting job statistics. An interesting fact is that California is the state with the highest demand for accountants and auditors in the country.

(Big4, Statista)

5. 72% of self-employed contractors do their bookkeeping and accounting errands without professional help.

A survey by AccountancyAge in 2017 discovered that most self-employed contractors don’t use any professional bookkeeping help. About 18% responded that they get some assistance, while 7% use specialist accountants. An interesting detail in these bookkeeping statistics is that 2% of all participants said family and friends help them with accounting. Still, the job outlook for accountants has continuously been positive.

(AccountancyAge)

6. Almost two-thirds (62%) of small businesses don’t find their accountant responsible for the taxes they pay.

This is the answer most business owners gave to the question of whether they think their accountants could do more to lower their taxes. Small business accounting statistics show that about 24% of the participants said that they are undecided on this matter. Only 14% responded positively and said that they expected more from their accountants. In the same study, most business owners pointed to their accountant as their highest-ranked professional in terms of importance.

(Wasp Barcode)

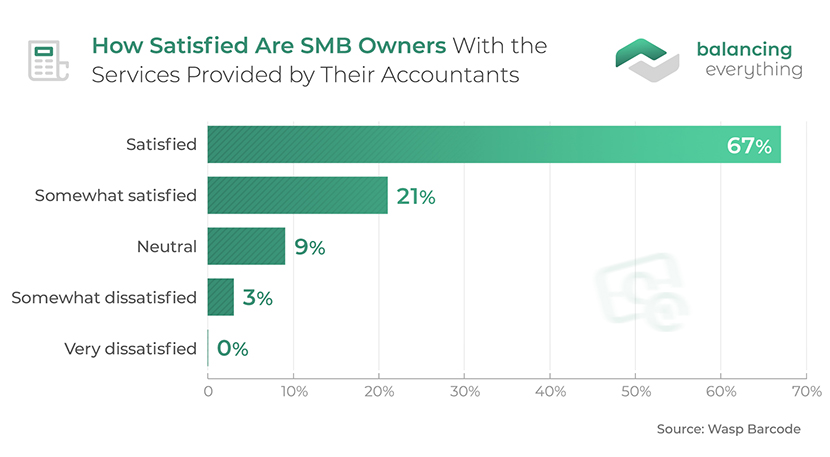

7. More than two-thirds (67%) of SMB owners are satisfied with the services provided by their accountants.

Wasp Barcode, in their Small Business Accounting Report, asked owners whether they are satisfied with the service they get. The accounting statistics reveal that most of the participants responded positively, whereas none of them were very dissatisfied. Somewhat satisfied, neutral, and somewhat dissatisfied was the chosen response for 21%, 9%, and 3%, respectively. An impressive 91% of companies with 26-100 employees are satisfied with their accountant’s efforts. These high service satisfaction levels are among the reasons for the ever-growing demand for accountants.

(Wasp Barcode)

Accounting Industry Statistics

8. 21% of SMBs owners admit to not knowing enough about bookkeeping.

With business owners feeling like this, the employment outlook for accountants is bound to improve. It seems that the importance of this position is finally earning the respect it deserves among SMBs. An ICAS 2016 study meanwhile discovered that 30% of SMBs owners consider accountants to be their most reliable collaborators.

(Wasp Barcode)

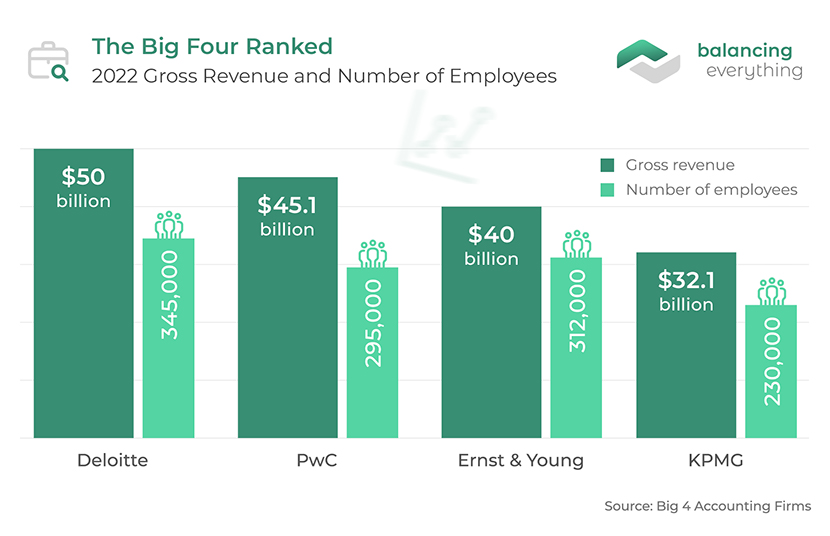

9. The Big Four accounting/audit firms made a combined gross revenue of $167.2 billion in the USA in 2021.

These four enterprises—Deloitte, PwC, Ernst & Young, and KPMG—are also the largest employers of accounting professionals and clerks. Deloitte and PwC employ 345,000 and 295,000 accounting professionals, respectively. Statista’s US accounting stats show that 312,250 and 236,000 people work for Earns & Young and KPMG, respectively. It’s important to note that the accounting job satisfaction in all these enterprises is considerable.

(Big 4 Accounting Firms)

10. 35% of self-employed contractors stress out about making an accounting mistake.

AccountancyAge reports that making a mistake is the biggest fear of self-employed contractors who do their accounting. The completion time length and the complexity of the process are sources of concern for 15% and 13%, respectively. Finally, about 5% of the participants named financial penalties as their primary headache when it comes to bookkeeping.

(AccountancyAge)

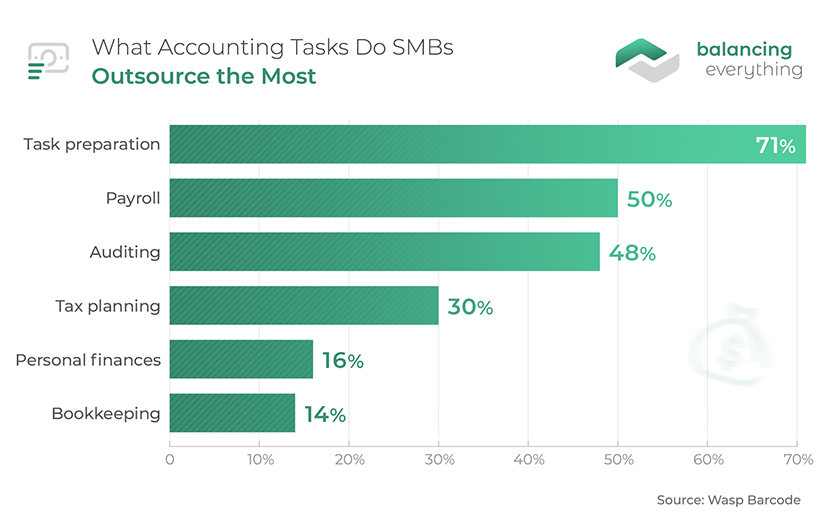

11. Task preparation (71%) and payroll (50%) are the two most outsourced tasks of SMBs.

In its 2016 study, Wasp Barcode discovered that most SMBs outsource task preparation and payroll when it comes to accounting tasks. According to the same bookkeeping industry statistics, these are followed by auditing (48%) and tax planning (30%). The last on the list are personal finances with 16% and bookkeeping with 14%. So, it’s good to have these figures in mind when trying to calculate your accountant job outlook.

(Wasp Barcode)

Accounting Job Statistics

12. 36% of accounting professionals are satisfied with their job.

Job satisfaction statistics place accounting in the top three most liked jobs alongside management analytics and market research. Also, candidates in the accounting field express high confidence (80%) in finding employment in the industry. This confidence aligns with the positive job outlook for accountants.

(Monster)

13. 82% of accountants are open to hiring candidates from a nontraditional background.

Accuracy and certification remain vital aspects of picking the right employee. That said, 82% of accountants would hire someone from a nontraditional background. About 43% of responders, according to the latest accounting statistics, say that new accountants should have experience outside of this field. Also, diversity is starting to play a role in the recruitment process of accountants, with about 30% of businesses admitting to actively trying to diversify their labor.

(Sage Practice of Now 2019)

14. The annual median pay for accounting, bookkeeping, and auditing clerks in the US is $42,410.

These candidates need fewer qualifications than accountants and auditors, and this reflects on their average yearly salary. Clerks in the US accounting industry get paid a median hourly rate of $20.39. Accounting statistics show these professionals need some college and no degree to successfully do their job. Often, such positions require no previous experience, either.

(BLS)

15. The US median accounting job salary in 2020 was $73,560 per year.

In its latest report on Accountants and Auditors, the US Bureau of Labor Statistics revealed the average rate per hour was $35.37. The same Bureau of Labor statistics on accounting show that the lowest 10% made less than $45,220 a year. In contrast, the highest-paid accounting salaries were over $128,680 annually. Most accountants stateside hold full-time positions, and many of them clock in more than 40 hours a week.

(BLS, BLS)

16. The nation’s BLS reported that there were 1,318,550 accounting jobs in the USA in Q1 2021.

The accounting job growth rate for the period 2020-2030 is 7%. By 2030, the Bureau of Labor statistics on accounting are likely to show an employment change of around 96,000. This means that the nation’s accountants and auditors’ workforce will stand at about 1,488,200 jobs in 2030. The best prospects are for those who hold the Certified Public Accountants certificate and established professional recognition. Those with an MBA also have a better accounting job outlook when compared to the rest.

(BLS, BLS)

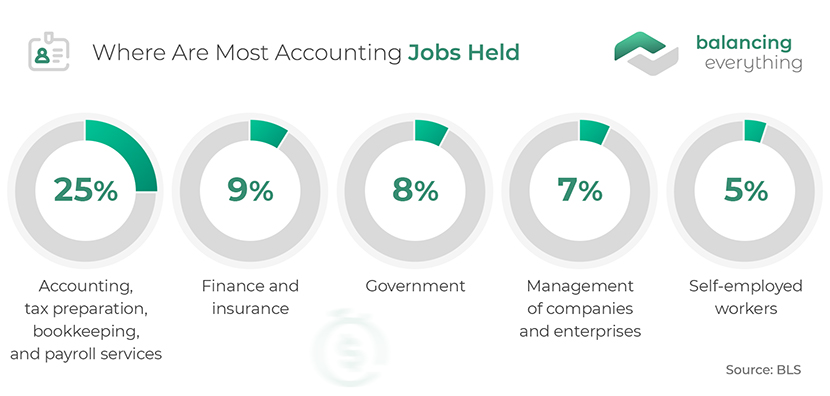

17. Most of the accounting jobs in the US (25%) are in firms that offer accounting, tax preparation, and payroll services.

The finance and insurance sector alongside the government are the second-largest employers with 9% and 8%, respectively. The BLS accounting stats place about 7% of accounting professionals and clerks in company management. Another 5% of specialists in this field are self-employed workers.

(BLS)

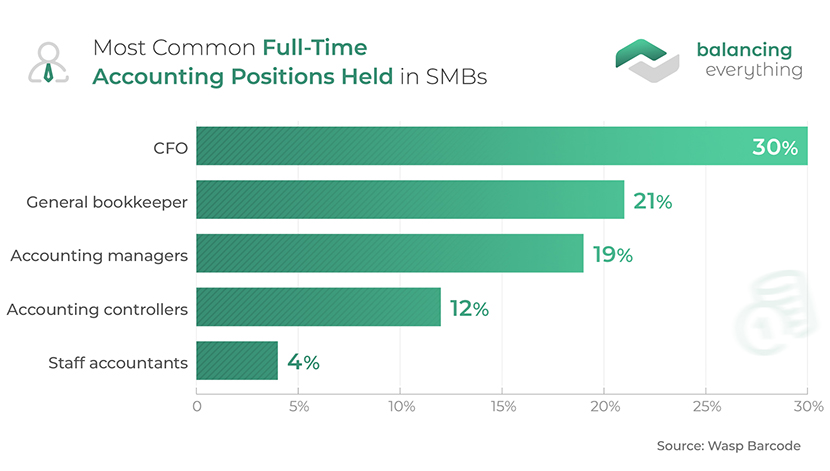

18. CFO is the most common full-time accounting position held in small businesses with 30%.

Wasp Barcode has established that the second most common accounting position in SMBs is a general bookkeeper (21%). With 19% and 12%, next on the list come accounting managers and controllers, respectively. Finally, staff accountants make about 4% of bookkeeping jobs in SMBs.

(Wasp Barcode)

19. 74% of small businesses don’t understand how ghost assets affect their taxes and accounting books.

This is worrisome information since about $3.6 billion globally is lost to fraud, according to accounting fraud statistics presented in an ACFE study. The same study discovered that an organization typically loses around 5% in revenue due to fraud every year. Among the 74% who responded negatively to the question, 49% had no idea what ghost assets are. Only 26% of the Wasp Barcode participants said they know what ghost assets are and how they affect their books.

(Wasp Barcode, ACFE 2020 Report to the Nations)

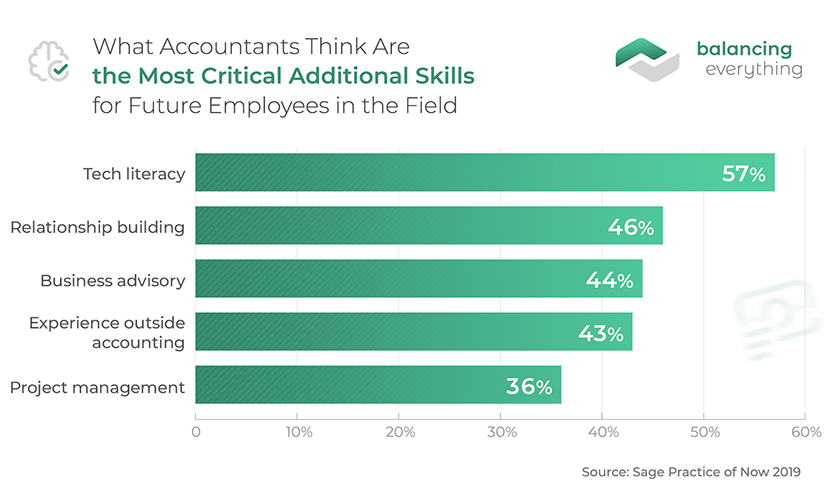

20. 57% of accountants find technology literacy to be the most critical additional skill for future employees in the field.

As the times are changing, the average accountant needs more skills than bookkeeping. The Sage 2019 bookkeeping statistics list all the necessary skills for accountants to join the industry. Most participants (57%) found tech literacy to be the most important. Next comes relationship building (46%), business advisory (44%), and experience outside accounting (43%). Only 36% of the responders consider project management a vital skill of a future accountant.

(Sage Practice of Now 2019)

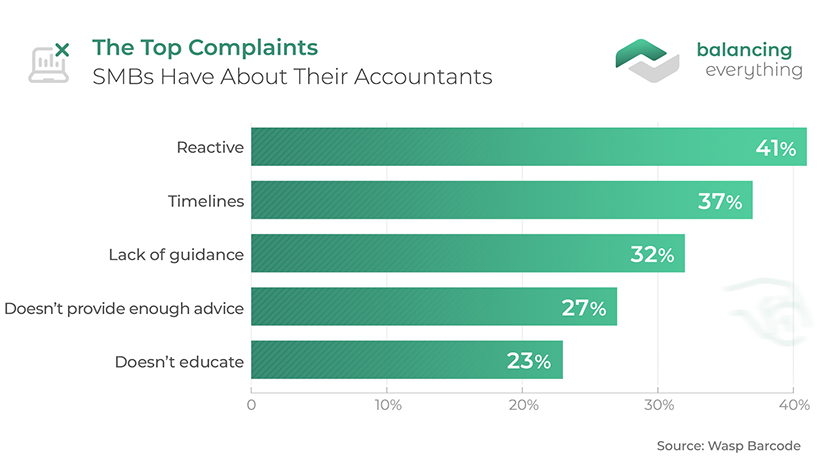

21. Being reactive is the top complaint (41%) small businesses have about their accountant.

Among companies with 11-25 employees, 41% find being reactive instead of proactive the main issue with their accountant. Timelines (37%) and lack of guidance (32%) complete the list of the top three complaints, per the latest small business accounting statistics. These business owners also feel that their accountant doesn’t provide enough advice (27%) and doesn’t educate them (23%). The results are similar when compared to the responses from owners of businesses that employ 26-100 people.

(Wasp Barcode)

22. 21% of accountants point out market demands as the main reason for the evolution of the accounting industry.

In its 2019 report, Sage determined the main reasons for a cultural shift in the accounting field. Most of the responders named market demands as the top reason. This shows that accounting experts are trying to accommodate the needs of their clients by adopting the latest trends and practices. Accounting software statistics further show that 16%, 15%, and 13% answered with regulations, ongoing digitization, and generational changes, respectively. The list is rounded up with client demands (13%) and investments (12%). Interestingly, about 10% of those who took the survey claimed that there was no evolution at all.

(Sage Practice of Now 2019)

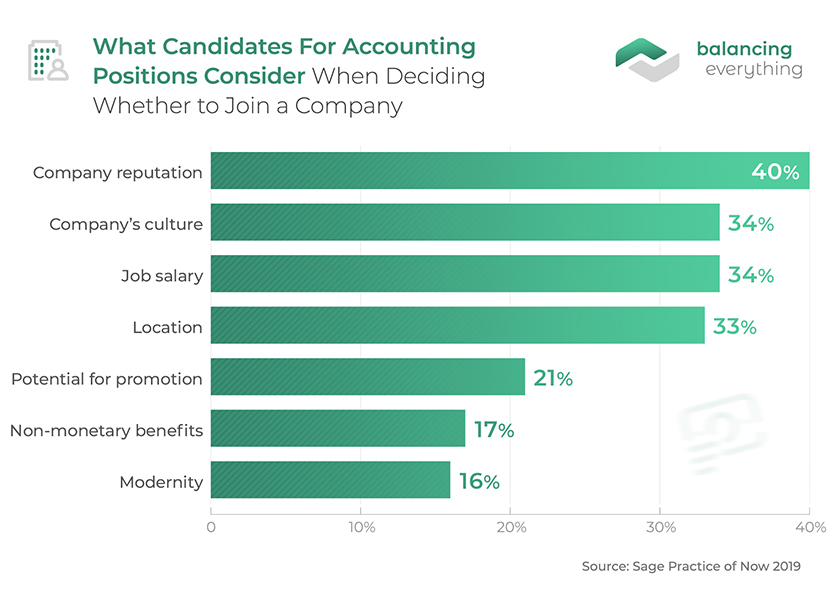

23. Reputation is the main reason why candidates for accounting positions choose to join one firm over another.

Company reputation was selected by 40% of the participants in the Sage Practice of Now 2019 study. Accounting industry statistics further show that equally important (34%) are the company’s culture and accounting job salary. Location can make or break the deal for 33% of future staff. Candidates also pay attention to the potential for promotion (21%), non-monetary benefits (17%), and modernity (16%). So, this is something employers should have in mind, with the job outlook for accounting majors improving, thus expanding their options.

(Sage Practice of Now 2019)

24. Accounting is ranked #42 on the U.S. News’ 100 Best Jobs list.

Flexibility, upward mobility, and stress level are among the factors considered in the ranking process. The U.S. News bookkeeping industry statistics also show that accounting has high upward mobility and an average stress level. Flexibility-wise, it offers above-average work vs. life balance and an alternative working schedule. Accountants stateside further have good prospects to get promotions, make more money, and improve.

(U.S. News)

25. Bachelor’s was the most popular accounting enrollment program in 2018, with 207,806 students.

Ever since 1993, the Bachelor’s program has attracted the most students in comparison to the other accounting enrollment programs. The AICPA accounting graduates statistics point to Masters in Accounting and Master’s in Taxation as the two other popular picks. The number of students in those programs in 2017-2018 was 27,482 and 2,645, respectively. Only 3,208 graduates opted for the MBA in Accounting, while the Ph.D. program recorded 732 enrollments.

(AICPA 2019 Trends Report)

Accounting Software Statistics

26. The global accounting software market is expected to reach $20 million by 2026.

The global accounting software market was worth $12.01 million in 2019. Based on the latest forecasts, by 2025, this value should soar to $19.59 million and should surpass $20 billion by 2026.

(Fortune Business Insights)

27. The cloud accounting market could reach $4.25 million by 2023, from an estimated $2.62 million currently.

Flexi’s cloud accounting statistics also conclude that most accountants (67%) prefer cloud accounting. Unlike on-premise software, cloud-hosted solutions reduce operating expenses by up to 50%. Also, 58% of enterprises are already using this type of service. Switching to cloud accounting has boosted revenues for accounting businesses by 15%.

(Flexi)

28. About 67% of accountants prefer cloud accounting.

This shouldn’t be a surprise given the resulting reduction in labor costs. AccountancyAge forecasts that 78% of SMBs would depend on cloud accounting software by 2020. These accounting statistics highlight the slow but undeniable progress of cloud bookkeeping towards establishing itself as the norm.

(Sage Practice of Now 2018)

29. More than half (56%) of accountants admit that technology is increasing their productivity.

An even bigger share (58%) has invested in accounting software to meet their clients’ expectations. Another interesting fact here is that about a third (38%) of accountants think that current training programs can help them sustain the business only by 2030.

(Sage Practice of Now 2019)

30. 82% of small businesses and 58% of enterprises use cloud accounting.

Cloud accounting statistics show that businesses that have cloud bookkeeping in place note, on average, a 15% y-o-y revenue growth. This highlights the importance of cloud-hosted accounting solutions. A study conducted by Xero, moreover, established that companies with cloud accounting could handle five times more clients than businesses without cloud accounting.

(Viewpost, Xero)

31. Accounting automation returns the investment within 6-18 months.

The benefits of employing full accounting automation go beyond saving time. Such solutions also save accountants and companies money. The investment pays for itself in up to 18 months. Vanguard Systems A.P’s accounting software statistics further show that accounts payable automation saves up to $16 per invoice. Automation further minimizes the chances of human errors and inaccurate calculations.

(Vanguard Systems)

32. 22% of accounting firms strongly agree that AI would improve their operations and automate their tasks.

Artificial intelligence has found its way to various industries worldwide. Accounting seems to be one of the sectors that warmly welcome it. Namely, more than half of accounting firms (58%) said that AI would help with their work and automate daily tasks. Accounting stats show that among them, 22% ‘strongly agree’ with the statement and 36% ‘agree’ with it. Less than one-third of responders (28%) are neutral on the topic, while only 13% disagree.

33. Nearly 50% of accountants intend to use automation.

When it comes to where accountants would implement automation, 45% say they intend to automate repetitive, time-consuming accounting tasks such as data entry and number-crunching, while 40% say they intend to automate invoicing and accounts payable processes and workflows.

(Sage Practice of Now 2020)

34. 58% of accountants say automation improves efficiency and productivity.

Accounting statistics reveal that, out of the accounting professionals who already use automation, 41% said it had made their staff more competent and confident. 35% said updating their technology had helped them keep pace with client expectations and increased retention rates. At the other end of the spectrum, Only 6% of respondents said they don’t believe automation can help with any business tasks at their firm.

(Sage Practice of Now 2020)

35. 85% of accounting professionals think that their country’s accountants should implement technology to remain competitive in the global market.

Most accountants believe that the industry in their country is lagging globally due to the slow implementation of technology. The lack of funds (38%) and time (13%) are the two main reasons for the gradual digitalization worldwide.

(Sage Practice of Now 2019)

The Balance

The world is constantly changing and the accounting industry follows suit. As these accounting statistics have shown, new technologies are now reshaping the sector, driving it towards less manual work and pre-emptive problem-solving. Given the importance of accounting, it remains to be seen how the changes in the industry will impact the business world going forward.

References:

BLS, The Business Research Company, Sage Practice of Now 2019, Fortune Business Insights, Viewpost, Flexi, Sage Practice of Now 2020, Big4, Statista, AccountancyAge, Wasp Barcode, Wasp Barcode, Monster, BLS, BLS, ACFE 2020 Report to the Nations, Sage Practice of Now 2019, U.S. News, AICPA 2019 Trends Report, Sage Practice of Now 2018, Xero, Vanguard Systems

Leave a Reply