Accounting Cycle

The accounting cycle is the process that a company uses to track its financial performance over a given period. The bookkeeping cycle starts with transactions as they occur and ends with the preparation of financial statements and the closing of the books. So, let’s go over the basics to give you a better idea of the concept.

How the Accounting Cycle Works

The accounting process cycle is applied broadly across the entire reporting period. The accounting cycles periods will vary depending on reporting needs. According to accounting data, most firms aim to evaluate their performance monthly, though some may focus more heavily on quarterly or annual results.

The financial accounting cycle is also helpful in keeping up to date with the company’s methods of recording transactions to prevent fraudulent activity, which has been on the rise, according to accounting fraud statistics.

Overall, determining the length of each accounting period cycle is crucial since it establishes hard dates for opening and closing. After a basic accounting cycle closes, a new cycle begins, starting the eight-step accounting process from scratch. Of course, most of the process is performed with the assistance of accounting software.

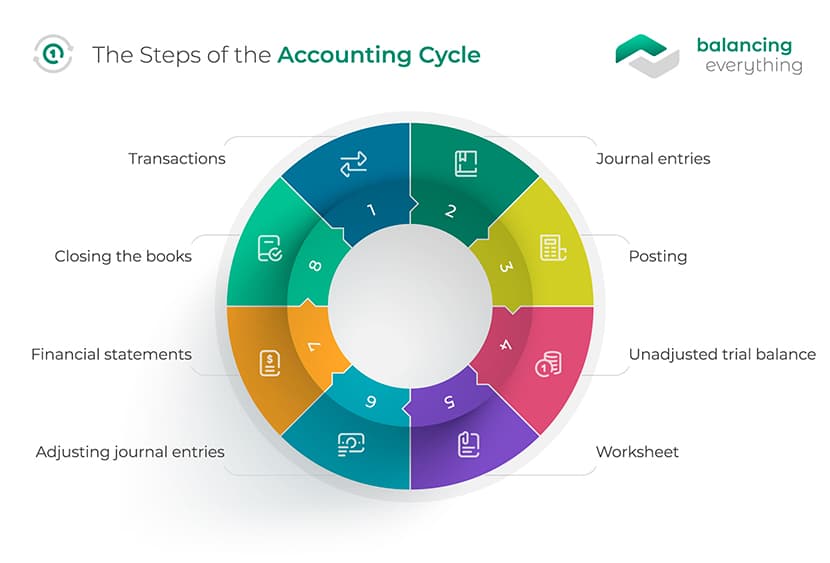

The Steps of the Accounting Cycle

There are eight steps in the accounting process, so let’s go over them individually.

1. Transactions

You need to start the accounting cycle process with transactions. These might be selling products or services, paying salaries, purchasing supplies, or other financial activities.

2. Journal entries

Next, the transactions are listed in chronological order in the appropriate journal to further allow for a seamless financial statement preparation later. It’s usually done based on a document, such as an invoice, and based on the chosen accounting method.

3. Posting

The third of the steps of the accounting cycle is to apply transactions to the account they impact. These accounts, which form part of the general ledger, provide a broad overview of all business accounts.

4. Unadjusted trial balance

The trial balance is an accounting cycle report that shows the assets, liabilities, and owners’ equity at the end of the accounting period (which may be a month, quarter, or year, depending on a company’s policies). In this stage, a lot of mistakes can be detected.

5. Worksheet

The fifth of the accounting cycle steps is when the accounting specialist checks if the books balance and, if they don’t, make the required adjustments, which are tracked in a worksheet. Adjustments are also made to account for the depreciation of assets and one-time payments (such as insurance) that should be allocated monthly to more accurately reflect monthly expenses with monthly revenues. You take another trial balance after making and recording adjustments to verify that the accounts are in harmony.

According to cloud accounting statistics, most companies store these statements safely using modern technological tools.

6. Adjusting journal entries

To correct any mistakes in the affected accounts, you must submit any required adjustments to the records once your trial balance proves that the accounts will be balanced after they are adjusted. You don’t have to adjust entries until the trial balance is finished and all necessary changes and modifications have been identified.

7. Financial statements

Once all the needed adjusting entries are posted, the company can prepare the financial statements for all users of accounting information. Typically, the order of financial statement preparation goes as follows:

- Income statement

- Statement of retained earnings — also called Statement of owners’ equity

- The balance sheet

- Statement of cash flows.

8. Closing the books

The last step of the accounting cycle is to close the period in the closing month of the accounting year. It involves completing all the accounts and preparing to start the accounting process all over again. Once this is done, the full accounting cycle is officially closed.

Accounting Cycles Examples

Accounting Cycle of a Merchandising Business vs. Accounting Cycle of a Service Business

There are a few key differences between the accounting cycles of a merchandising and service business. For one, a merchandising company typically has inventory that inventory accounting needs to record, whereas a service business does not. It means that there are additional accounting process steps for a merchandising business, such as preparing the financial statements involved in recording the purchase of inventory and calculating the cost of goods sold.

Additionally, since a service business does not have inventory, the accounting associate does not need to use the same accounting procedures to represent the cost of goods sold on its income statement.

Finally, the revenue recognition principle is applied differently in a service business than in a merchandising business. In a service business, revenue is typically recognized when the service is performed, whereas, in a merchandising business, revenue is recognized when the goods are sold.

Back Office vs. Front Office Accounting Cycle

Front office accounting refers to the accounting activities directly related to revenue generation. It includes Accounts Receivable, Billing, and Collections. Back office accounting refers to all other accounting activities, such as Accounts Payable, General Ledger, Financial Reporting, and Payroll Accounting.

Another difference is that front-office accounting is typically done by staff who are in contact with customers, unlike back-office accounting. Finally, front office accounting tends to be more complex due to the need to track customer information and generate invoices. Both processes can benefit from accounting automation.

The Timing of the Accounting Cycle

The financial accounting cycle typically lasts for 12 months. There are, however, differences in when the 12-month period starts. While some companies use a January-to-December cycle to match the calendar year, others opt for following the April-to-March operating cycle in accounting. Public companies in the US must file their statements with the Securities and Exchange Commission, meaning their accounting period cycle will be synchronized with reporting requirement dates.

Accounting vs. Budget Cycle

While related, these two cycles are not quite the same thing. The budget is a plan of how much money a company will earn and spend over a specific period, meaning it focuses on future events. The cycle of accounting, meanwhile, represents historical (past) events.

Accounting vs. Operating Cycle

The life cycle of accounting begins after the operating cycle in accounting has ended. This is because financial statements are prepared using information from the operating cycle.

The operating cycle is the average time it takes a firm to invest cash to produce items, sell them, and get money from customers in return for those items. This is useful for determining how much working capital a company will require to keep or develop its business.

A company with a short operating cycle may require less money to run its operations, allowing it to expand while still earning relatively small margins. A firm with fat margins will require more financing to grow at even a modest rate and might have an unusually lengthy operational cycle. If a business is a reseller, the operating cycle simply refers to the time between when it buys products from a supplier and when it re-sells them to customers.

Importance of the Accounting Cycle

The accounting cycle is vital because it helps companies track their actual results against their budget while following the golden rules of accounting. Should discrepancies arise, the company can make adjustments and devise another plan.

It is also essential because it helps companies keep track of their cash flow. The cash flow statement shows a company’s actual cash flow for a specific period of time. Moreover, the cycle also helps companies keep track of their profits and losses. This information is also helpful in making decisions about whether or not to invest in a company.

Accounting Cycle FAQ

What is the accounting cycle?

According to the definition of the accounting cycle, it is the process of recording business transactions.

What is the purpose of the accounting cycle?

The purpose is to help companies track their actual results against their budget.

What is the first step in the accounting cycle?

The first step in the accounting cycle is recording transactions. Transactions are any events that affect a company’s financial situation. For example, a company might record the sale of a product or the payment of rent.

What is the last step in the accounting cycle?

The last step is closing the cycle, finalizing all the statements, and preparing for the next cycle.

How often does the accounting cycle occur?

The cycle can occur every month. Some companies, however, may choose to do it quarterly or annually.

What is the difference between the accounting and budget cycle?

The accounting cycle definition shows that this process relates to past events and ensures that financial activities are recorded correctly. The budget cycle, on the other hand, is focused on future operations and planning for future activities.

What is full-cycle accounting?

Full cycle accounting is the process of recording transactions, posting journal entries, making adjustments, and preparing financial statements.

In what order are financial statements prepared?

The accounting cycle order for preparing financial statements is the balance sheet, the income statement, the statement of cash flows, and the statement of changes in equity.

Which financial statement is prepared last?

When thinking about the order to prepare financial statements, the statement of changes in equity is prepared last. This statement shows a company’s changes in equity during a specific period of time.

How many steps are there in the accounting cycle?

The complete accounting cycle has eight steps: recording transactions, posting journal entries, making adjustments, preparing a trial balance, worksheet, adjusting journal entries, preparing the financial statements, and finally, closing the books.

What are the major products of the accounting cycle?

The products of the accounting cycle are the balance sheet, the income statement, the statement of cash flows, and the statement of changes in equity. These products are generated from the recording of transactions, the posting of journal entries, and the making of adjustments.

What is the correct sequence for closing the temporary accounts?

Regarding the order of accounting statements, the sequence for closing the temporary accounts includes expenses, gains, and losses. This sequence is also known as the accrual basis of accounting.

What records classified and summarized transactional data?

Records that classified and summarized transactional data are the journal entries. Journal entries are the second step in the full accounting cycle. They are used to record transactions in a company’s accounting system.

How is the balance sheet derived?

The balance sheet is derived by totaling a company’s assets and subtracting its liabilities. This calculation gives a company’s net worth. Assets are everything a company owns, and liabilities are everything a company owes. The balance sheet is one of the essential financial statements established throughout the accounting cycle.

Leave a Reply