Corporate Taxes by State – A Complete Rundown

In addition to the countrywide federal corporate tax, individual US states have their own corporate charges. Meaning, depending on where you register your company, you may have to pay more than 21% in corporate taxation. But what exactly is corporate income tax? Do all states have it? What are the rates of corporate taxes in different states? The answers to these questions are relevant to anyone who wants to run a business in the US. If you are also in this category, you’ll find all this information and more in this ultimate guide on corporate taxes by state.

What Is Corporate Tax?

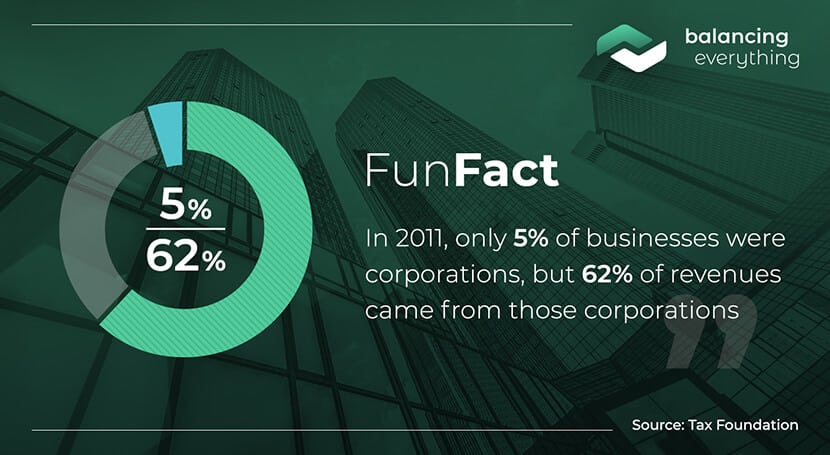

Corporate tax is the tax corporations pay on their taxable income. Corporations are also known as C Corp businesses, where owner limited liability protection applies. Corporations exist as separate legal entities from their owners, and they pay higher taxes due to double taxation.

In small businesses, the owner pays company taxes through their personal income taxes. Corporations pay corporate taxes, while business owners are separately taxed on their personal income. These owners, however, are not responsible for the company’s debts, actions, etc.

(Patriot Software)

Federal vs. State Corporate Taxes

There are two types of corporate taxes that American C Corps pay.

The first one is the federal corporate tax, whose rate in 2022 is 21%. It used to go up to 35% before the Tax Cuts and Jobs Acts entered into force in 2017. All corporations, regardless of their state, pay the federal corporate tax. You can calculate it by subtracting your business expenses from the yearly revenue and then multiplying that amount by the federal corporate tax rate.

Let’s say your revenues are $200,000, and your expenses are $50,000. Your corporation’s taxable income, therefore, is $150,000. We multiply that by 0.21 (the federal tax rate is 21%). The result of $31,500 represents the amount of federal corporate tax due.

Then there are the state corporation tax rates. The situation here is a bit more complicated since not all states have a corporate tax, and the rates vary.

(Patriot Software, Tax Foundation)

Corporate Tax by State in the United States

Besides the federal corporate tax, some states impose additional taxation on businesses operating on their territory. In fact, only six states don’t have this tax. Some have flat rates and other varying rates that depend on the taxable brackets.

Scroll down to dive deeper into the corporate income tax rates by state and discover other notable types of business taxes too. We will analyze them from worst to best.

New Jersey Corporate Tax Rate

New Jersey tops our list with an 11.50% tax on corporate income. There are four taxation levels, and how much a business pays depends on its taxable income. The minimum tax C corporations pay, however, goes between $500–2,000. The corporate income tax brackets in the Garden State range from $0 to $1,000,000. With a federal corporate tax of 21%, New Jersey has combined tax rates starting at 27.5% and going up to 30.1%.

(Tax Foundation, New Jersey Division of Taxation)

Pennsylvania Corporate Tax Rate

At 9.99%, Pennsylvania has the second highest corporate tax rate by state. Consequently, the state’s combined federal and state corporate tax rate is 29%, making it the second-worst destination for corporations.

Pennsylvania, however, doesn’t have any franchise or privilege taxes. Another notable type of business tax in this state is the sales tax of 6%. Plus, Allegheny County and Philadelphia purchases come with an additional local tax of 1% and 2%, respectively.

(Tax Foundation, Pennsylvania Department of Revenue)

Iowa Corporate Tax Rate

Iowa used to have the highest business tax rates by state among all US states but lowered its rate from 12% to 9.8% through a tax reform package. The Corn State has varying state corporate taxes. The lowest rate starts at 5.5%, while the highest rate is 12%. The taxation brackets in Iowa go between $0 and $250,000, with four different levels, taking the combined corporate tax in Iowa to 29%.

(Tax Foundation, Ohio Department of Taxation)

Minnesota Corporate Tax Rate

Minnesota is another one of the locations with state corporation tax rates — they impose a corporation tax of 9.8% on top of the federal tax. This gets us to the combined corporate tax in Minnesota for C corporations of 29%. While the tax rate is flat, the minimum fee isn’t. It ranges from $0 for corporations with less than $1,050,000 in total property, payroll, and sales to $10,480 for businesses worth over $41,910,000.

(Tax Foundation, Minnesota Department of Revenue)

Illinois Corporate Tax Rate

The Illinois state corporation taxes are income tax of 9.50% and replacement tax of 2.5%. The combined state and federal corporate tax rates stand at 29%.

Besides the two state taxes mentioned above, Illinois imposes a 0.15% franchise tax and a 6.25% sales tax on general merchandise. The sales tax on food, drugs, and medical appliances in Illinois is 1%. Finally, some local jurisdictions can apply their local fees, which can represent an additional tax burden for Illinois corporations.

(Tax Foundation, Illinois General Assembly)

Alaska Corporate Tax Rate

Alaska’s corporate tax goes from 0 to 9.4%. The corporate tax brackets in the Last Frontier move from $25,000 to $222,000, with 10 taxation levels. So, in 2022, the combined US corporate tax rate in Alaska started at 21% and went up to 28%.

On the flip side, there is no statewide sales tax in this state. Individual jurisdictions, however, can set taxation rates and sales tax of up to 7.5%. Most Alaskan cities also have no property tax, but the largest ones impose an average of 1.18%. This average is higher than the US property tax average of 1.07%.

So, this state doesn’t have a significant tax rating when it comes to corporations. The situation is better when focusing on small business tax rates by state, as these don’t pay income tax to Alaska.

(Tax Foundation, Avalara, SmartAsset)

Maine Corporate Tax Rate

Maine comes next on the highest corporate taxes by state list with 8.93%. Stephen King’s state has four taxation levels, so the tax rate is closely related to the income of the corporation, starting at 3.50%. The combined federal and corporation tax rates meanwhile go from 24.50% to 27%.

Maine has a sales tax of 5.5% as well as a franchise tax. For the latter, businesses can choose between two options. They can pay 1% on income and 0.008% on assets or 0.039% on assets only.

(Tax Foundation, Maine Revenue Services)

California Corporate Tax Rate

After analyzing corporate taxes by state in 2022, California earned a spot in the top 10 with its high flat rate of 8.84%. Businesses operating in the Golden State, therefore, pay a combined corporate tax of 28%.

California has a minimum franchise tax of $800, which applies to every corporation that is incorporated, registered, or doing business in the state. There is also a statewide sales tax of 7.25%, plus some district taxes of 0.10%–1%.

(Tax Foundation, California Franchise Tax Board, California Department of Tax and Fee Administration)

Delaware Corporate Tax Rate

Delaware has a flat state business tax of 8.7%, which leads to a combined corporate tax of 28%. The state, however, doesn’t have any sales tax, unlike most other states.

On the flip side, Delaware has a franchise tax. For businesses with 5,000 authorized shares, it costs $225 per year ($50 annual report fee + $175 tax). Corporations with at least 5,001 authorized shares have an annual report fee of $50, plus tax between $200–$200,000.

While Delaware may not be the best place for running a business, savings statistics show that it has the highest average savings.

(Tax Foundation, DelawareInc)

Vermont Corporate Tax Rate

Vermont has varying state corporate tax rates. The Green Mountain State has a base tax and tax rates on top of it. For businesses making up to $10,000, there is no base tax, and the rate is 6.0%. Corporations with income between $10,001 and $25,000 the base tax is $600, while the additional tax rate is 7.0% on the amount over $10,000. Finally, those making over $25,000 pay a base fee of $1,650 and an additional 8.5% on the amount over $25,000. The combined corporate tax in Vermont is 28%.

Besides the state business tax, Vermont also has a minimum tax on gross receipts. The brackets for this start at $0–$2,000,000, with two more for amounts between $2,000,001 and $5,000,000 and those over $5,000,001, while the minimum tax is $300, $400, or $750, respectively. There’s also a Vermont sales tax of 6% not to overlook.

(Tax Foundation, Vermont Department of Taxes)

Washington, DC Corporate Tax Rate

Businesses in DC pay state corporate income taxes of 8.25%. There is also a minimum tax in play for corporations. Businesses pay $250 if gross receipts are up to $1,000,000 and $1,000 if gross receipts are over $1,000,000. Considering the federal corporate tax is 21%, DC businesses end up paying a combined business tax of 28%.

DC further imposes sales taxes of 6%.

(Tax Foundation, DC Office of Tax and Revenue)

Maryland Corporate Tax Rate

Maryland is another US state with a flat corporate tax rate of 8.25%. Meaning, the combined business taxation is 28%.

While there is no state tax on corporate property, some jurisdictions apply local property tax. Most counties impose taxes on the depreciated value of the business’s personal property. Maryland also has a sales tax of 6% and an alcoholic beverage tax of 9%.

(Tax Foundation, Maryland Taxes)

Massachusetts Corporate Tax Rate

Massachusetts belongs on the wrong side of the list when comparing business rates by state. The Bay State imposes a flat corporate tax of 8%, and the minimum fee is $456. This US state has combined corporate tax rates of 27%. Massachusetts, in fact, applies a corporate excise tax. First, we have the taxable net income tax of 8%. Then, there is the property measure of $2.60 per $1,000 of either tangible property or taxable net worth.

Besides having a high business tax rate by state, Massachusetts also has an above-average sales tax of 6.25%.

(Tax Foundation, Massachusetts Department of Revenue)

Louisiana Corporate Tax Rate

Louisiana has interesting business tax brackets. Namely, corporations pay 3.5% on income up to $50,000 and 5.5% on the next $100,000. Finally, on the excess over $150,000, companies pay a business tax of 7.5%. So, the combined corporate taxation in Louisiana is 24.5%–27%, depending on the company’s taxable income.

Businesses in Louisiana wouldn’t want to ignore the franchise tax either. They pay $1.50 for each $1,000 of capital employed up to $300,000 and $3 on each $1,000 over the $300,000 threshold. The initial franchise fee is $110. On top of these taxes comes the sales tax of 4.45%. So, Louisiana has pretty high corporate taxes by state.

(Tax Foundation, Louisiana Department of Revenue, Louisiana Department of Revenue)

Wisconsin Corporate Tax Rate

Wisconsin applies a flat 7.9% state corporate tax on businesses’ taxable income. Combined with the 21% federal tax, the total corporate tax rate imposed on companies reaches 27%.

Wisconsin has a 5% sales tax, a 0.5% county tax, and a 5% use tax.

(Tax Foundation, Wisconsin Department of Revenue)

Nebraska Corporate Tax Rate

For taxable income up to $100,000, the Nebraska business tax rate is 5.58%. If the corporation’s income is over $100,000, then the business tax is $5,580 plus 7.5% of the amount over $100,000. These figures place the combined corporate taxes in Nebraska at 27%.

Nebraska also has a sales and use taxation of 5.5% plus local additions between 0.5%–2%.

(Tax Foundation, Nebraska Department of Revenue)

New Hampshire Corporate Tax Rate

New Hampshire imposes two separate state business tax rates. The first is called a business profits tax and stands at 7.7%, while the second—called a business enterprise tax—is 0.6%. These rates vary and depend on the combined amount of general and education trust fund revenue. The state’s combined state corporate income tax in 2022 is 27%.

New Hampshire has no statewide sales tax. There are some exceptions, like the taxes of 9% on restaurants, 7% on telecommunication services, and 9% on car and room rentals.

(Tax Foundation, New Hampshire Department of Revenue, Sales Tax Handbook)

Oregon Corporate Tax Rate

C corporations in Oregon pay calculated or minimum tax, whichever is higher. The minimum tax ranges from $150 to $100,000, and the corporation tax brackets are up to and over $100,000,000. The taxation rates are 6.6% for taxable income up to $1,000,000 and 7.6% for taxable income over $1,000,000. The combined state and federal rate goes up to 27%.

There are no sales or use taxes in the Beaver State.

(Tax Foundation, Oregon Department of Revenue)

Connecticut Corporate Tax Rate

Connecticut applies a business tax of 7.5% on the net income of companies. Combined with the federal tax of 21%, the total corporate taxation in the state reaches 27%.

The state has a sales tax of 6.35% and certain exceptions. Renting or leasing motor vehicles for up to 30 calendar days is taxed at 9.35%. Data processing services, meanwhile, are taxed at 1%.

(Tax Foundation, Connecticut Department of Revenue)

Rhode Island Corporate Tax Rate

In our list of corporate tax rates by state, Rhode Island earned a spot in the top 20 with its business tax of 7%. Meaning, companies pay a combined corporate tax of 27%.

Up until 2014, Rhode Island imposed a franchise tax of $2.50 per $10,000 of authorized capital stock. This tax was subsequently repealed. There is, however, a sales tax of 7% on retail sales, rentals, or leases of goods and services.

(Tax Foundation, Rhode Island Department of Revenue)

Kansas Corporate Tax Rate

In Kansas, businesses that have a net income of $50,000 pay a state corporate tax of 4%. Kansas companies with net income over $50,000 pay an additional 3% surtax on the excess amount. The Sunflower State has combined corporate state tax rates of 27%.

Kansas also imposes a sales tax of 6.5%.

(Tax Foundation, Kansas Department of Revenue)

Idaho Corporate Tax Rate

The Gem State’s tax rate in 2011 was 7.6%. Today, however, corporates in Idaho pay a tax of 6% on their taxable income. The state has a combined business tax of 26%.

Businesses in Idaho must pay a sales tax of 6%. Plus, there’s the permanent building fund tax, which is $10 for C corporations.

(Tax Foundation, Idaho State Tax Commission)

Montana Corporate Tax Rate

Montana has a standard corporate income tax of 6.75% or a combined business tax of 26%. The minimum corporate tax in the state is $50. Corporate state tax returns in Montana are due on May 15 (calendar year).

Other fees to keep in mind are the water’s edge election tax (7%) and the alternative gross sales tax (0.5%). The latter affects Montana businesses with gross sales in the state of up to $100,000. The Big Sky Country doesn’t have general sales, use, or transaction taxes.

(Tax Foundation, Service Now)

Alabama Corporate Tax Rate

Before 2001, Alabama used to have a business income tax rate of 5%, which was lifted to 6.5% in 2001. Corporations pay a combined income tax of 25%.

Alabama has a few other noteworthy fees we must mention when analyzing corporate taxes by state. First, there’s the business privilege tax between $0.25–$1.75 per $1,000 of net worth. The minimum business privilege tax in Alabama is $100, while the maximum stands at $15,000, with some exceptions.

(Tax Foundation, Alabama Department of Revenue)

West Virginia Corporate Tax Rate

This state has a flat corporate tax of 6.50%, or combined rates totaling 26%.

West Virginia also has both state and local sales and use taxes. The statewide sales tax is 6%, while the municipal sales tax is 1%. The state used to impose a franchise tax until 2015 when it reduced it to 0. Meaning, West Virginia comes in somewhere in the middle when jurisdictions are rated based on business taxes by states.

(Tax Foundation, West Virginia Tax Division)

Tennessee Corporate Tax Rate

Next on the list of highest to lowest corporate income tax by state comes Tennessee. Here, companies cover a flat corporate charge of 6.5%, which results in combined business taxation of 26%.

Tennessee corporations pay 7% general state sales tax plus local sales tax. The combined rates go between 8.5%–9.75%. Businesses also have a franchise tax of 0.25%, whose minimum fee is $100.

(Tax Foundation, Tennessee Department of Revenue)

New York Corporate Tax Rate

Business taxpayers owe 6.5% if their business income goes up to $5 million, while the tax rate for incomes above that threshold is 7.25%. So, the combined federal and state corporate tax in New York State is 26%. C corporations also have a business capital base tax of 0.1875% to think about.

New York State has a statewide sales tax of 4% and a local sales tax of 4.5%. The latter can boost the combined tax rate to a maximum of 8.875%.

(Tax Foundation, New York Department of Taxation and Finance, New York Department of Finance)

Arkansas Corporate Tax Rate

Arkansas has varying business tax rates. These range from 1.0%–5.5% and depend on the five taxation levels. The brackets that decide the tax rate start at $0 and go over $25,000. These percentages result in combined state corporate income taxes of 26%.

There’s also a varying franchise tax, which is either a percentage or a flat fee. Corporations/banks with stocks, for instance, pay 0.3% of their outstanding capital stock. The minimum charge is $150. Mutual assessment insurance corporations, in contrast, pay only $300.

(Tax Foundation, ArkansasInc)

Hawaii Corporate Tax Rate

Hawaii isn’t one of the states with the lowest corporate tax, but its business tax burden isn’t terrible either. There are three tax rates in the Aloha State — 4.4%, 5.4%, and 6.4%. The brackets are up to $25,000, between $25,001–$100,000, and over $100,000. That puts the combined business tax in Hawaii at 26%.

Hawaii has a general excise and uses tax instead of a sales tax. It comes with a one-time fee of $20 and rates ranging from 0.15%–4%. Some counties also have surcharges between 0.25%–0.50%. You mustn’t overlook the state franchise tax of 7.92% either.

(Tax Foundation, Hawaii Department of Taxation)

Virginia Corporate Tax Rate

The United States corporate income tax rates are flat in many states. With a business tax of 6%, Virginia belongs in this category alongside many other jurisdictions. Companies, therefore, pay a combined income tax of 26%.

Besides the Virginia corporate tax rate, businesses in this state also pay the sales tax. In most areas, the sales tax is 5.3%. In some areas, like Central Virginia or Hampton roads, this rate is 6%, while for certain counties or cities, it can be as high as 7%.

(Tax Foundation, Virginia Tax)

Oklahoma Corporate Tax Rate

Corporations in the Sooner State pay state income tax of 4% or combined federal and state income tax of 24%. These state corporation tax rates aren’t bad, but businesses in Oklahoma have other charges to worry about too.

First, there’s the annual franchise tax on companies of $1.25 per $1,000 of capital invested or used in the state. Second, Oklahoma has a sales tax of 4.5% statewide, plus up to an additional 0.35%–7% of local sales taxes. There’s also a sales tax permit fee of $20 and an additional $10 for other locations.

(Tax Foundation, Oklahoma Tax Commission, Sales Tax Handbook)

Michigan Corporate Tax Rate

C corporations operating in the state of Michigan must pay a corporate income tax of 6%. Meaning, businesses pay combined corporate taxes by state of 26%.

We must mention the Michigan business tax of 4.95% alongside the modified gross receipts tax of 0.8%. The state also imposes sales and use taxes of 6% each. All these expenses make Michigan a worse choice than some of the states that have higher business income taxes.

(Tax Foundation, Michigan Department of Treasury)

New Mexico Corporate Tax Rate

For taxable years after January 1, 2020, New Mexico imposes a corporate income tax of 4.8% on net income up to $500,000. There is also a surcharge of 5.9% on income over $500,000. So, the state corporation taxes in New Mexico are either flat at 26% or 26% plus the 5.9% surcharge.

Businesses must pay a franchise tax of $50 per year. What about sales in New Mexico? Well, the state doesn’t have it, but it has a gross receipt tax ranging from 5.125% to 8.8675%.

(Tax Foundation, New Mexico Taxation and Revenue Department)

Georgia Corporate Tax Rate

Georgia imposes a corporate income tax of flat 5.75%, so businesses in the state pay combined income taxation of 26%. Besides the corporate income tax, companies in Georgia also pay a net worth tax of up to $5,000, depending on the company’s net worth.

America’s Peach State has a sales and uses tax of 4%. Since local jurisdictions can levy their sales and use tax, the total rate ranges from 4%–9%.

(Tax Foundation, Georgia Department of Revenue, Avalara)

Indiana Corporate Tax Rate

Indiana is among the states with the lowest corporate taxes. This state imposed an adjusted gross income tax of 5.50% for the period between July 1, 2019, and June 30, 2020. Then, it decreased the rate to 5.25% until June 30, 2021, and 4.9% from July 1, 2021, onward. Meaning, the combined Indiana corporate tax rate was 26.50% until June 30, 2020. This rate, however, dropped to 26.25% afterward and finally to 25%.

The sales tax is 7%, and there is no franchise tax.

(Indiana Department of Revenue, Tax Foundation)

South Carolina Corporate Tax Rate

South Carolina has a state corporate tax rate of 5% and an annual license fee of 0.1% of capital alongside a $15 charge. This results in a combined federal and state income tax of 25%, with the annual license fee excluded. South Carolina is one of the 10 American states with lowest corporate tax.

Businesses working in the Palmetto State should also consider the sales and use tax of a flat 6%. In some counties, there is a surcharge of 1%, too.

(South Carolina Department of Revenue, Tax Foundation)

Kentucky Corporate Tax Rate

Businesses based in the State of Kentucky pay a corporate income tax of 5% or a combined business tax of 25%.

Financial institutions in Kentucky whose receipts equal or exceed $100,000 must pay the bank franchise tax. This fee is annually taxed at 1.1% of net capital, and the minimum charge is $300. The Bluegrass State also imposes a statewide sales and use tax of 6%, and there are no local surcharges.

(Tax Foundation, Kentucky Department of Revenue)

Mississippi Corporate Tax Rate

Mississippi has a graduated corporate income tax system, and its rates go between 4% and 5%. There are two business tax brackets in the Magnolia State, for businesses with incomes below and above $10,000. Depending on their taxable income, Mississippi C corporations pay combined taxes of up to 25%.

Despite having a low corporate tax rate by state, Mississippi isn’t all that tax-friendly, with a sales and use tax of 7%. This rate applies to most retail sales, but there are exclusions taxed at 1%, 1.5%, 3%, or 5%, too. Mississippi also has a franchise tax of $2.25 per $1,000 of capital employed that can’t be under $25.

(Tax Foundation, Mississippi Department of Revenue)

Utah Corporate Tax Rate

Corporations operating in the territory of Utah must pay an income tax of 4.85%. So, the combined taxation rate Utah businesses pay on their income is 25%.

Utah sales and use tax ranges between 4.7% and 8.7%, and most counties impose their local sales and use tax of 1%.

(Tax Foundation, Avalara)

Arizona Corporate Tax Rate

Arizona is another US jurisdiction that prides itself on low corporate income tax rates by state. The Grand Canyon State has had a flat business income tax of 4.9% since December 2016. This means that companies in its territory pay a combined corporate tax of 25%.

It’s important to mention that Arizona imposes a transaction privilege tax of 3.3%, plus counties apply additional country excise tax, too.

(Tax Foundation, Arizona Department of Revenue)

Colorado Corporate Tax Rate

Colorado has decreased its corporate income tax twice and, as of January 2020, it stands at 4.55%. This percentage results in combined corporate taxation of 24%. Only four jurisdictions have lower corporate taxes by state than Colorado.

Colorado has state sales and state use taxes of 2.90% each. Plus, there’s a service fee of 4%, which is capped at $1,000. Cities and counties impose their sales and use taxes as well as service fees.

(Tax Foundation, Colorado Department of Revenue)

Florida Corporate Tax Rate

In the period between January 01, 2019, and December 31, 2021, the corporate income tax in Florida was 4.458%. From January 01, 2022, the tax is 5.5%, meaning that the combined business tax is currently 25%.

While Florida has low state business tax rates, its sales tax is in line with the US average. Corporations in the Sunshine State pay a general sales tax of 6%, but there are some lower and higher exceptions too. Also, some counties impose discretionary sales surtaxes.

(Florida Department of Revenue, Tax Foundation)

North Dakota Corporate Tax Rate

North Dakota has low business income tax rates, especially for businesses whose taxable income isn’t over $25,000. These pay only 1.41% in corporate tax. C Corporations with taxable income between $25,000–$50,000 pay $352.50 plus 3.55% on the amount over $25,000. Finally, a tax rate of 4.31% on taxable income over $50,000 plus $1,240 is imposed on businesses with income over $50,000. With these three corporate income tax brackets, the combined tax rate in North Dakota stands at 24%.

It’s important to mention that corporations can choose to use the water’s edge income apportion method. In this case, the state applies a surtax of 3.5% on the taxable income.

North Dakota also has a general sales tax of 5%, which is under the US average. There are exceptions where the sales tax is either 3% or 7%. Individual cities and counties levy local sales and use taxes, as well.

(North Dakota Office of State Tax Commissioner, Tax Foundation)

Missouri Corporate Tax Rate

Before January 01, 2020, Missouri imposed a business tax of 6.25%. The state decided to lower the tax rate to 4%, which resulted in a combined business income tax of 24%. So, in 2022, Missouri has the second-lowest business tax rates by state.

Missouri businesses should consider the 4.225% sales and use tax. There used to be a franchise tax as well, but it was lowered to 0% back in January 2016.

(Missouri Department of Revenue, Tax Foundation)

North Carolina Corporate Tax Rate

From an all-time high corporate income tax of 7.50%, North Carolina lowered this rate to 2.5% in 2019. So, in 2022, North Carolina is the state with the lowest corporate tax, with combined taxation of 23%.

C corporations also pay a franchise tax of $1.50 per $1,000, and the minimum fee is $200. North Carolina imposes sales and uses charges of 4.75%, and counties add their surcharges between 2%–2.75%.

(North Carolina Department of Revenue, Tax Foundation, North Carolina Department of Revenue, North Carolina Department of Revenue)

Fun Fact — The United States collected over $319 billion in corporate tax income in the fiscal year 2022.

(Fiscal Data)

States With No Corporate Income Tax

As of 2022, there are six that don’t impose a corporate tax in the United States.

Having no corporate taxes, however, doesn’t always mean that companies in those states are left with more money. Each state relies on different income sources and applies other taxes or fees that make up for the lack of business tax.

Nevada

Companies in Nevada pay an annual $200 Business License Fee for operating within the state’s borders. The Silver State also imposes a commerce tax on businesses with gross revenue over $4,000,000. Since Nevada is one of the states with no corporate tax, many consider the commerce tax to be its replacement. With rates of 0.051%–0.331%, however, the commerce tax is much lower than the average state business taxation. We also must mention the sales tax of 4.6%, which is the state’s primary source of income.

(Tax Foundation)

Ohio

In Ohio, the federal and state corporate tax rate is 21%, as the state doesn’t impose state corporate taxes. Businesses, however, must pay the Commercial Activity Tax (CAT). CAT applies to all businesses with gross annual receipts of at least $150,000. CAT is paid annually, except for companies that have gross receipts of over $1,000,000. They must file and pay the CAT every quarter. Ohio’s CAT rate is 0.26%. So, despite being one of the no corporate tax states, Ohio still finds a way to tax businesses on its territory.

(Tax Foundation)

South Dakota

South Dakota not only doesn’t impose taxation on corporations, but it’s also one of the most tax-friendly American states. Businesses operating in this state should keep in mind the Bank Franchise Tax applied to financial institutions. Also, there’s a sales tax of 4.5%, which still isn’t enough to shatter the tax-friendly reputation of the Mount Rushmore State.

(Tax Foundation, Nolo)

Washington

The Evergreen State is also among the states without business income tax. Companies here aren’t without any expenses or obligations, though. First, there’s the sales tax which ranges from 6.5% to 10.4%. Then, there is the public utility tax applied to public service businesses and companies in several industries.

Finally, there is a business & occupation tax contingent on the company classification. For retailing, wholesaling, manufacturing, services & other activities, the rate is 0.00471%–0.15%. There are also specialized B&O tax classifications whose taxation either falls within these thresholds or is a bit higher or lower.

(Avalara, Washington Department of Revenue)

Wyoming

Wyoming is not simply one of the states with no business tax — it is the tax haven for US corporations as it neither has state corporate income tax nor gross receipts tax. Two significant types of taxes that affect businesses in this state are the property tax and the sales tax.

The property tax is 11.5% for industrial properties and 9.5% for residential, commercial, and other properties. There’s also an annual report fee of $50 or 0.0002% per business asset, whichever is greater. LLCs based in Wyoming with assets of up to $300,000 pay a minimum of $60.

The sales tax in Wyoming is 4.0%. Individual municipalities also impose local sales taxes, which additionally boost the total rate. Still, with most states having sales tax alongside corporate tax, Wyoming remains an excellent destination for basing your business.

(Best Wyoming Registered Agent)

Texas

Texas is the last representative of the states with no corporate income tax. Besides the federal corporate tax of 21%, businesses in the Lone Star State should worry about the franchise tax and the sales tax.

The franchise tax rate in Texas varies by year. In 2021, the no-due threshold was $1,180,000. The respective tax rates for retail or wholesale and other than retail or wholesale were 0.375% and 0.75%. The EZ computation rate was 0.331%, while the EZ computation total revenue threshold was $20 million.

Texas also has a sales and use tax of 6.25% on retail sales, leases, and rentals of goods. Local taxing of up to 2% is possible, too, meaning the total tax rate goes up to 8.25%.

(Comptroller)

The Bottom Line

In 2022, North Carolina is the US jurisdiction with the lowest corporate taxes by state. New Jersey ended on the worse end of the table, having the highest business income tax rate. Businesses in the USA can, however, avoid corporate taxation. This is easily achieved by registering a corporation in one of the six states that don’t have this type of tax.

It’s important to remember, nonetheless, that many other fees affect C corporations. The franchise tax, the privilege tax, and the sales tax are to name a few. So, it’s essential to analyze the tax situation as a whole before deciding where to base your business.

References: Patriot Software, Tax Foundation, Tax Foundation, Tax Foundation, New Jersey Division of Taxation, Pennsylvania Department of Revenue, Ohio Department of Taxation, Minnesota, Department of Revenue, Illinois General Assembly, Avalara, SmartAsset, Maine Revenue Services, Maine Revenue Services, California Franchise Tax Board, California Department of Tax and Fee Administration, DelawareInc, Vermont Department of Taxes, Vermont Department of Taxes, DC Office of Tax and Revenue, DC Office of Tax and Revenue, Maryland Taxes, Massachusetts Department of Revenue, Massachusetts Department of Revenue, Louisiana Department of Revenue, Louisiana Department of Revenue, Wisconsin Department of Revenue, Nebraska Department of Revenue, New Hampshire Department of Revenue, Sales Tax Handbook, Oregon Department of Revenue, Connecticut Department of Revenue, Rhode Island Department of Revenue, Rhode Island Department of Revenue, Kansas Department of Revenue, Idaho State Tax Commission, Idaho State Tax Commission, Service Now, Alabama Department of Revenue, Alabama Department of Revenue, West Virginia Tax Division, West Virginia Tax Division, Tennessee Department of Revenue, Tennessee Department of Revenue, New York Department of Taxation and Finance, New York Department of Finance, ArkansasInc, ArkansasInc, Hawaii Department of Taxation, Hawaii Department of Taxation, Virginia Tax, Oklahoma Tax Commission, Sales Tax Handbook, Sales Tax Handbook, Michigan Department of Treasury, Michigan Department of Treasury, New Mexico Taxation and Revenue Department, New Mexico Taxation and Revenue Department, Georgia Department of Revenue, Avalara, Indiana Department of Revenue, South Carolina Department of Revenue, South Carolina Department of Revenue, Kentucky Department of Revenue, Kentucky Department of Revenue, Mississippi Department of Revenue, Mississippi Department of Revenue, Avalara, Arizona Department of Revenue, Colorado Department of Revenue, Florida Department of Revenue, Florida Department of Revenue, North Dakota Office of State Tax Commissioner, North Dakota Office of State Tax Commissioner, Missouri Department of Revenue, Missouri Department of Revenue, North Carolina Department of Revenue, North Carolina Department of Revenue, North Carolina Department of Revenue, Fiscal Data, Tax Foundation, Tax Foundation, Tax Foundation, Nolo, Avalara, Washington Department of Revenue, Washington Department of Revenue, Best Wyoming Registered Agent, Comptroller, Comptroller

Leave a Reply