Financial Literacy Statistics

The latest financial literacy statistics suggest that people worldwide still need guidance in handling their money. While financial literacy is essential for amassing wealth and avoiding debt, both youth and adults lack this knowledge.

What is inflation, how to invest your money, and why do saving goals matter? These are just some of the questions that financial education answers.

If you’d like to learn more about this vital concept, read further. Below, we will reveal 27 worrying stats and answer the most common queries on the topic.

Financial Literacy Statistics (Editor’s Choice)

- The average rate of financial literacy in Europe is 52%.

- 50% of adults worldwide understand inflation and interest rates.

- The average score on the US national financial literacy test hovers around 67.5%.

- North Dakota residents know the most about handling personal wealth.

- West Virginia youth has the highest literacy rate on money issues of 72.71%.

- Americans over 51 years old represent the most financially literate age group with an average score of 78.03%.

- Only 12% of Millennials have asked for professional help with personal finances.

Global Financial Literacy Statistics and Trends

1. Australia, Canada, Denmark, Finland, Germany, Israel, the Netherlands, Norway, Sweden, and the UK have the highest financial literacy rates.

In these countries, financial literacy among adults is at least 65%. In South Asia, there are low levels of financial literacy of 0–24%. Most African and South American countries have moderate financial literacy of 25–34%. In Russia, several Middle Eastern countries, and some European countries, financial literacy is 35–54%.

(S&P Global Financial Literacy Survey)

2. In Europe, the average economic literacy among adults is 52%.

Northern EU countries have the highest understanding of money issues, as indicated by the latest financial literacy trends. Germany, UK, Denmark, the Netherlands, and Sweden note literacy of at least 65%. European countries with an average knowledge of how to handle money among adults are Greece (45%), Spain (49%), and Italy (37%). Bulgaria and Cyprus have financial literacy of 35% each, while Romania’s adults underperform with a rate of only 22%.

(S&P Global Financial Literacy Survey)

3. People in major economies have a better knowledge of fundamental financial issues.

The average rate of financial literacy in those countries, including Canada, Australia, and the US, is 55%. Per the financial illiteracy statistics, the situation is the opposite among the major emerging economies. These have low rates, with the average being only 28%. Here, we must mention India and South Africa with knowledge rates of 24% and 42%, respectively.

(S&P Global Financial Literacy Survey)

4. Inflation and interest rates are the best-understood concepts worldwide.

About 50% of adults know about both. Only 35%, in comparison, understand risk diversification. A bit more (45%) of adults globally know about the concept of compound interest, according to financial literacy stats.

Figures differ drastically when we compare understanding between advanced and emerging economies. In major economies, about 64% of the citizens understand risk diversification. The rate is only 28% among the adults living in emerging economies. The difference between the rates is lower for the other concepts, yet not insignificant.

(S&P Global Financial Literacy Survey)

5. There’s a gender gap in financial literacy.

Men have higher financial literacy than women. About 35% of men got 3 out of 4 answers correct, compared to about 30% of women. Women also have higher ‘don’t know’ rates, according to the S&P financial literacy statistics.

While in advanced economies people are more understanding of all concepts in general, women still fall behind. There, nearly 60% of men got 3 out of 4 topics correct, while only 50% of women did the same. The situation is similar in emerging economies, despite the overall lower literacy levels. Equality between men and women exists only in China and South Africa, when it comes to financial knowledge, at least.

(S&P Global Financial Literacy Survey)

6. There’s an age gap in financial literacy.

Global youth financial literacy statistics show that people aged 15–35 are the most financially literate with a 35% rate. People over 65 are the least familiar with handling their money — 25%. The average in advanced economies is 56% among those under 35 and 63% among those aged 36-50. People over 65 are the least literate in this category too, with only 45% understanding the concept. Emerging economies also follow this trend, albeit with lower overall rates.

(S&P Global Financial Literacy Survey)

7. Wealthy people understand money issues better than low-income individuals.

Globally, about 25% of the poorest 40% are financially literate, according to financial illiteracy stats. Over 35% of the wealthiest 60%, by contrast, are well-aware of how to handle personal assets. The difference is even more significant in advanced economies where about 45% of the poorest 40% are literate compared to 60% of the richest 60%.

(S&P Global Financial Literacy Survey)

8. Account owners can be financially illiterate too.

Globally, 60% of all people hold an account, and only about 38% of them are financially literate. These financial illiteracy statistics show that 62% of account holders don’t have relevant money-handling knowledge. In advanced economies, over 95% of individuals have bank accounts, and 57% of those are financially educated. In emerging economies, about 70% are account holders, and about 35% have money managing skills.

(S&P Global Financial Literacy Survey)

Financial Literacy in the US

9. Americans scored an average of 67.5% on the national financial literacy test.

The average score up to date is 67.5%, and the percentage of failing scores is 57.5%. Financial literacy high school statistics show that the average score among Americans aged 15–18 in 2022 was 63.5%. While the percentage has dropped slightly in the past couple of years, the overall trend remains positive. In 2016, for example, it stood at 59.5%, as indicated by the NFEC financial literacy survey.

(National Financial Educators Council)

10. Americans over 51 hold the highest average score on the national financial literacy test to date.

Their average score to date is 78.03%, higher than any other age group. US citizens aged 36–50 and 25–35 come in next with average scores of 77.26% and 76.04%, respectively. As the youth financial literacy statistics reveal, the average scores are significantly lower among younger Americans. The average financial literacy for youth aged 10–14 and 15–18 is 56.91% and 63.52%, respectively. Finally, the National Financial Educators Council results show that the average score to date for those 19–24 is 70.92%.

Only 24% of boomers, however, have a written retirement plan. Moreover, another 24% prefer not to think about the plans until they get closer to their retirement date.

(National Financial Educators Council, TransAmericaCenter)

11. Most Americans give wrong answers to investing, setting personal goals, and credit-building questions.

Only 44.27% knew how much money they would have if they invested $100 at the age of 21. The question focused on investment with an annual return of 7%. Approximately 46.33% knew how to set personal goals, and 45.89% guessed the first step toward building a good credit score. Other worrisome facts about American financial literacy show that 20% don’t keep any track of their finances at all and almost 70% of Americans have less than $1,000 in savings or nothing at all.

(National Financial Educators Council, Secrets to Get Organized in Minutes, Statista)

12. West Virginia has the highest youth financial literacy by state.

In this state, the rate of economic literacy among young residents is 72.71%, show the youth financial literacy statistics. North Dakota and New Mexico complete the top-three list with their rates of 70.07% and 68.38%, respectively. States with the lowest knowledge on money issues are Arkansas (52.64%), Delaware (56.52%), and Georgia (59.44%).

(National Financial Educators Council)

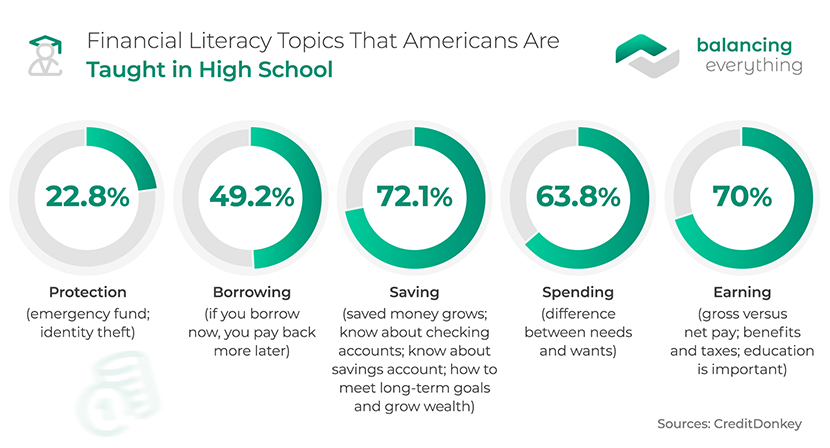

13. Most Americans were taught about saving in high school.

More than 70% (72.1%) were taught about saving money, checking accounts, and meeting long-term saving goals, according to financial literacy statistics. The concept of earning, including gross versus net pay, benefits, and taxes, was taught to 70% of high school students. Nearly two-thirds (63.8%) were educated about spending money responsibly, such as the difference between needs and wants.

Just under half (49.2%) learned about borrowing and how you pay back more than you have initially borrowed. There’s an apparent lack of financial education in schools on the topics of protection. Only 22.8% of Americans learned about this concept in terms of identity theft and having an emergency fund. That’s why global identity theft stats show that the US has the most ID thefts in the world.

(CreditDonkey)

14. Financial literacy positively affects people’s credit scores.

Proper education on handling assets can not only result in positive financial literacy trends but in other improvements as well. In 2000, for example, Texas, Idaho, and Georgia introduced mandatory financial education. Within three years, the credit scores of students attending those classes increased significantly. The exact improvements were by 31.71 in Texas, by 16.19 in Idaho, and by 10.89 in Georgia. Only 15 US states require a personal finance course from high school graduates. If more states introduced this, financial literacy among youth would improve significantly.

(HuffPost, Next Gen Personal Finance)

15. A lack of financial knowledge can lead to fewer employment opportunities.

Financial illiteracy statistics show that 5.2% of Americans aged 35 to 54 that responded to a survey say they were turned down from a job due to their financial profiles. Moreover, 26.3% reported having employers do a financial background check on them. It’s estimated that a lack of education about money costs people an average of $9,724.83. One in three respondents reported losses of $15,000 while for one in four they were over $30,000.

(National Financial Educators Council, PRNewsWire)

16. North Dakota is the state with the highest level of financial literacy.

A recent study has placed North Dakota at the top spot for financial literacy, taking into account state laws on teaching the subject and how well residents perform on financial literacy quizzes. The runner-up is Minnesota, followed by New Hampshire, Nebraska, and South Dakota, to round up the top 5.

While the latest savings stats place Delaware as the top state with the highest retirement savings, it occupies the 42nd position for financial literacy.

At the bottom of the financial literacy ranking are West Virginia, Nevada, and Indiana.

(SmartAsset)

17. White Americans and Asians have better knowledge of handling money.

In a 2018 study consisting of six personal finance questions, White Americans and Asians scored an average of 3.2 correct answers. Financial literacy trends in the research showed that Hispanics followed with an average of 2.6 correct responses. African Americans gave 2.3 correct answers, while other races answered correctly three times on average.

(NFCS)

18. Americans with higher income are more financially literate.

A US Financial Capability research of 2018 tested people from three income groups on six different financial literacy topics. Those earning over $75,000 scored an average of 3.6 correct answers. Americans with income under $25,000 or $25,000–75,000 had averages of 2.2 and 3.0, respectively.

(NFCS)

19. Money management is among the most requested classes by high-schoolers in the US.

Youth financial literacy statistics show that a whopping 86% of those aged 16–18 would rather learn money management in school than make mistakes and have financial issues later in life. For another 75%, learning about money management is a top priority.

(SchwabMoneyWise)

20. Under half of young Americans would put an unexpected $1,000 into savings.

A recent survey showed that 37% of those aged 16 to 25 would put a $1,000 windfall into savings. Nine percent would use it toward buying a car, school, or paying bills, and 8% would go shopping (8%). Only 4% would consider investing it. As such, these financial literacy statistics indicate that most haven’t developed a saving and investing mindset.

(CNBC)

21. Nearly one-fifth of US teens haven’t learnt fundamental financial skills.

As many as 18% of teens lack fundamental financial skills, underscoring the importance of frameworks for teaching financial literacy. Data further indicates that having a different framework for teaching financial literacy at all stages of life, including childhood, could improve overall financial skills.

Some of the best-performing existing frameworks include the Financial Literacy and Education Commission’s My Money Five, and RAND Corporation’s Development of a K–12 Financial Education Curriculum Assessment Rubric.

(Youth.gov, MyMoney, Rând)

22. American teens score lower on financial literacy tests than their foreign peers.

An OECD study has presented rather troubling financial literacy statistics for US teens, as well as parents. Just one in 10 respondents earned a top ranking for financial intelligence. Even more worrisome, 22% of them failed to meet the baseline of financial competence. US teens ranked 7th, behind countries such as China, Russia, and Canada.

(CBSNews)

23. Only 34% of parents have taught their children how to balance a checkbook.

Even fewer of those have explained credit and interest to their teens. In a study conducted by Charles Schwab, 93% of American parents with teenagers said that they were afraid of their child making financial mistakes like overspending. 69% claimed that they felt less prepared to advise kids on investing than they do the “birds and the bees”. Also, 71% of college students cite parents as their top learning resource.

(SchwabMoneyWise, SallieMae)

Financial Literacy Statistics Among Millennials

24. Millennials need a better understanding of their finances.

The Millennial financial literacy on basic topics like numeracy and mortgages is about 24%. Only 8% of Millennials have significant financial literacy knowledge on asset pricing, inflation, and risk diversification. These figures show that this generation knows the fundamentals but isn’t familiar with the other financial literacy cornerstones.

(PwC)

25. Millennials aren’t happy with their knowledge of money issues.

Over one-third of millennials (34%) are unsatisfied, while 18% are not at all satisfied. People from this generation believe they don’t have the tools to change the situation, according to US financial literacy statistics. More than half (54%) worry about student loans and how to repay them. About 34% of millennials have an annual household income of at least $75,000 and worry about whether they’ll be able to repay college loans.

Other stats point to 43% who aren’t making any payments at all currently, while average student debt in the US stands over $35,000. It’s no wonder then that only 16% of young people aged 18 to 26 are very optimistic regarding their financial future, while 39% worry about it at least once a week. All this while the total student loan debt is $1.6 trillion.

Meaning, millennials need financial literacy more than any other generation to handle their money smartly and get out of debt.

(PwC, WallStreetJournal, BankofAmerica, Fidelity, NY Times)

26. College education doesn’t guarantee a better financial future for millennials.

Two-thirds of this age group carry at least one type of long-term debt. The share of educated millennials with at least one kind of long-term balance is much higher at 80%. Approximately 31% of all and 44% of college-educated millennials carry more than one source of long-term debt. These financial literacy college students statistics show that a university degree can help in terms of getting a better job. It can’t, however, substitute financial literacy in America.

It’s no surprise that just 24% of students and 20% of parents think they are prepared for the financial challenges of life. Also, 76% of students report that they need more help in matters of personal finance. Then, as many as 81% of college students admit to underestimating the time it takes to pay off credit balances.

(PwC, MX, An Encyclopedia of Modern Money Management)

27. Millennials don’t consult professionals when it comes to personal finance.

When we consider the financial literacy statistics for this generation, it’s somewhat surprising that only 12% of millennials decided to consult established financial advisors to help with debt. Less than a third (27%) asked for advice on investments and savings within the past five years. The lack of financial literacy is one of the reasons millennials make bad money decisions. Approximately 14%, for example, made a hardship withdrawal from their savings account. Two out of five millennials (42%) also used Alternative Financial Services such as payday loans, which are known for having soaring APRs.

(PwC)

Financial Literacy FAQ

What is financial literacy and why is it important?

Financial literacy is having the ability to understand how to make smart money decisions. Financially literate people know how to handle their assets, have healthy saving habits, and invest. All these lead to an improved financial situation and prevent debt generation. That’s the core importance of financial literacy.

Considering that the US is the country with the highest household debt, financial literacy is essential for fighting this negative trend. Those who know how to make smart money decisions are better equipped to grow their wealth.

What are the three main components of financial literacy?

Financial literacy statistics show those are budgeting, saving, and investing. The concept, however, doesn’t stop there. Spending, borrowing, and protecting are also essential aspects of understanding money. Each of these components of financial literacy covers a separate area of handling your assets and boosts your chance of achieving financial success.

How many people are considered financially literate?

About one-third of adults worldwide are financially literate. Meaning, about 3.5 billion people understand the basics of handling finances. Most of these people live in developed economies such as the US, the UK, and Germany. The percentage of financial literacy in the USA is only 57% among the adult population of the country, financial literacy statistics indicate.

How do you teach kids about money and personal finances?

Experts advise using any opportunity available, such as teaching price comparisons, value, and inflation at the grocery store. A trip to the ATM could meanwhile prove an excellent opportunity to teach that money doesn’t come from a machine. Allowing them to be part-time bill-payers is another great idea.

Takeaway

Americans, alongside people from other countries, must work on their financial literacy. Understanding the basic concepts of handling assets has many benefits, including wealth growth and smart investments.Besides being critical for economic success, financial literacy statistics show that most people lack appropriate knowledge. So, it comes as no surprise that even major economies like the US see soaring levels of household and consumer debts.

References: S&P Global Financial Literacy Survey, National Financial Educators Council, TransAmericaCenter, Secrets to Get Organized in Minutes, Statista, CreditDonkey, HuffPost, Next Gen Personal Finance, PRNewsWire, SmartAsset, NFCS, SchwabMoneyWise, CNBC, Youth.gov, MyMoney, Rând, CBSNews, SchwabMoneyWise, SallieMae, PwC, WallStreetJournal, BankofAmerica, Fidelity, NY Times, MX, An Encyclopedia of Modern Money Management

Leave a Reply