2024 Online Banking Hacking Statistics

Recent research revealed the total number of online banking users worldwide may reach 3.6 billion by 2024. While this growth seems impressive, cybersecurity in banking is becoming a grave concern as the digital economy expands.

The banking industry incurred the most cybercrime cost in 2018 at $18.3 million, and a good part of it resulted from hacking. Contrary to popular belief, hackers don’t only target large companies but users’ digital banking accounts as well.

These criminals are ruthless and can target anyone. Learn about the recent statistics in this article to help you protect yourself from online banking hacking and other related threats.

Editor’s Choice

- 42% of internet users don’t think their accounts are worth hacking.

- Bank transfer or payment frauds accounted for $756 million worth of losses in 2021.

- $3.1 billion was the accumulated reported loss of Americans due to cybercrimes.

- 20% of Account Takeovers resulted in financial loss.

- 43% of bank executives believe their banks are vulnerable to cyberattacks.

- Financial businesses are the targets of 25% of all malware attacks.

- Email is used in 96% of phishing attacks.

- FBI recorded 241,342 victims filing phishing complaints.

- The average amount lost per phishing attack is $136.

Online Banking Statistics

Banking plays a vital role in almost every household. It allows people to manage their money, buy their wants and needs, and save for the future. However, technology is ever-evolving, and here comes online banking.

The succeeding sections will give you an informed insight into this growing popular way of managing finances and the cyber threats that come with it.

Online Banking Consumer Statistics

The transition from traditional in-branch services to online banking did not happen instantaneously. The banking industry spent decades preparing even before Internet access became the norm.

Here are statistics about online banking consumers:

1. In 2022, 80% of millennials in the US used online banking services.

(PwC, Chase Media Center)

Age-related differences in the use of digital banking services are significant, with millennials using them more frequently (80%) than baby boomers (48.5%).

The most recent Chase Media Center study revealed that Millennials and Gen Z use mobile banking apps, like CashApp, for creating savings goals. In their study’s data, such age groups typically complete multiple tasks with the app.

2. 20% of adults do online banking while connected to a public WIFI.

(PewResearchCenter)

Due to its lack of security, a hacker may be able to get into a public Wi-Fi network and put viruses and malware on your device. However, 54% of internet users say they connect to a public WIFI connection.

3. 42% of internet users don’t think their accounts are worth hacking.

(LastPass)

People underestimate how valuable their information is. This type of mindset is the reason why 111.7 million Americans are hacked annually.

Even though you’re confident about being the last person to get hacked, cybercriminals have many other ways to make you pay.

| ✅ Pro Tip Secure your browser, and consider limiting what and how you share content online. |

4. 75% of American worry about cybercrime.

(Statista)

In 2022, 75% of Americans worried about hackers stealing their personal, credit card, or financial information. 73% were concerned about identity theft.

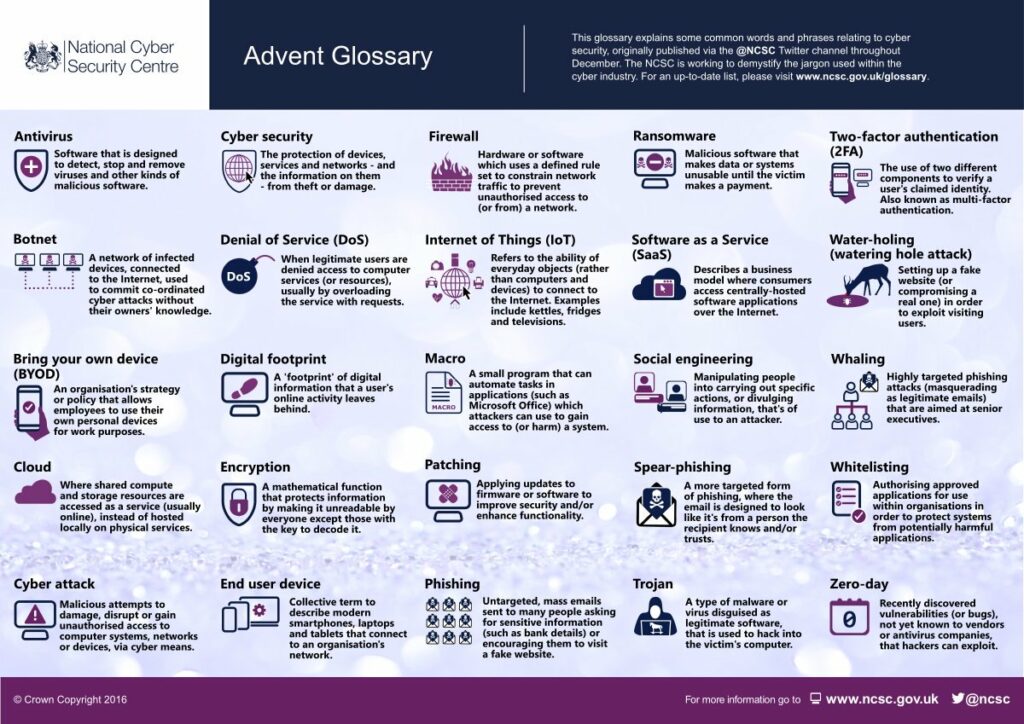

| 📝 Note: You should care about these issues, considering that cybercrime was and still is one of the most reported crimes globally. You can reduce the risk to yourself, your family, and your workplace by learning some basic terminology. Familiarize yourself with this helpful infographic from the UK’s National Cybersecurity Centre: |

Online Banking Fraud Statistics

American consumers lose more than $80 billion annually due to insurance fraud. Similarly, bank fraud is a severe problem affecting individuals worldwide. The most common committed fraud online is the following:

- Credit card fraud

- Identity theft

- Embezzlement

Read these digital banking fraud statistics to wise up and take some precautions against bank fraud:

5. 14% say someone has tried to open credit lines or take out loans in their name.

(Pew Research Center)

About 14% of Americans say that someone has tried to open credit accounts or get loans in their name, and 6% claimed that someone had tried to impersonate them to claim their tax refunds.

| 🎉 Fun Fact: Higher earners generally get better chances of opening credit accounts and loan approvals. Banks are more confident that the rich can repay the debt. |

6. Bank transfer or payment frauds accounted for $756 million worth of losses in 2021.

(Statista)

This incident was a 72% increase from dollars lost in 2019, which was $439 million.

| 📝 Note: What are bank transfer or payment frauds? These are financial scams affecting individuals and businesses. Typically, these happen when money is deposited into a bank account held by a cybercriminal. To trick victims into wiring money, these criminals impersonate a real person or use a trade name without authorization. |

Here are several types of bank transfer scams:

- Fake supplier fraud

- Bank account scams

- Fake president fraud

- Phishing

- Internal fraud

| ✅Pro Tip: To protect yourself from these frauds, only open accounts with banks with trusted security features. |

7. $3.1 billion was the accumulated reported loss of Americans (aged 60 and above) due to cyber crimes.

(FBI)

Seniors and older people are frequently the victims of identity theft, fraud, and other cybercrimes. Hackers and scammers find them more appealing because they have more wealth and better credit.

Here’s the reported loss due to cybercrime by age:

- Under 20: $210 million

- 20-29: $383.1 million

- 30-39: $1.3 billion

- 40-49: $1.6 billion

- 50-59: $1.9 billion

8. IC3 reported a $6.9 billion loss in the United States due to cybercrime in 2021.

(FBI, Sophos Cyber Security, CSO)

The recorded loss shows an increase over the previous year’s figure of $4.2 billion in 2020. Since 2017, this figure has continuously climbed upwards to $1.4 billion.

In 2018, the same report revealed 301,580 complaints regarding cybercrimes, accounting for $1.4 billion. The most consistent growth was phishing and other types of credential-based attacks. This expanded from 25,000 incidents in 2017 to nearly 324,000 in 2021.

Cyber security expert, Scott Schober, said:

| “Ransomware, it’s a big problem, and it’s not going away anytime soon.” |

Account Takeover (ATO) Statistics

Account takeover is a kind of identity theft and fraud when a hacker accesses a user’s login information. By posing as the victim, hackers can:

- update account information

- send phishing emails

- take financial information

- gain access to other accounts.

If you ever plan on investing in solutions to combat cybercrimes like account takeover, see its 2023 statistics below:

9. In 2021, 32% of ATOs were bank accounts.

(Security.org)

Of the accounts taken over, banking accounts were 32%. Social media accounts comprised 51% of account takeovers, while email and messaging platforms comprised 26%.

Here’s the breakdown:

10. Almost 1 in 4 Americans are account takeover fraud victims.

(Veriff)

22% of adults in the US have had their accounts taken over, which adds up to over 24 million households.

Hackers would usually make the following changes:

- Change the personal information

- Request a new card

- Add an authorized user

- Change the password

11. 20% of Account Takeovers resulted in financial loss.

(Security.org)

The average amount due to unauthorized access to financial accounts is almost $12,000.

An account breach can severely damage a business’s reputation. Customers are big on keeping their data safe. Hearing about account takeover fraud on the news could discourage them from opening an account with that business.

| ✅Pro Tip: Being reactive is the key to safeguarding your business from account takeover. It means establishing measures to detect and block fraudsters before they can perform a breach. |

12. Account takeover fraud is recognized by 74% of people as a potential hazard.

(Veriff)

According to research, 74% of people know that account takeover fraud poses a threat, and 18% are unaware of what it entails. Another 9% are unsure if they have even heard of it.

13. 93% of banking fraud occurs online.

(Feedzai)

Financial institutions must examine and strengthen their ability to detect, prevent, and mitigate fraud because 93% of banking fraud occurs online, and 83% of all card fraud happens online.

| ⚠️ Warning: Documents like bank statements, check stubs, tax-related papers, and credit card applications have enough data to set you up for identity theft if the wrong person gets their hands on the information. Do NOT throw papers like this in your trash bin. Shred them instead. |

Cyberattacks on Banks and Financial Institutions

Cyberattacks and data breach incidents remain a major threat to banks and financial institutions. In 2019, Boston Global Wealth reported that financial institutions are more likely to be targeted by cyberattacks.

Listed below are statistics showing why banks are gaining heavy-handed attention from criminals:

14. 43% of bank executives believe their banks are vulnerable to cyberattacks.

(KMPG)

43% acknowledged that their bank might be ill-equipped to protect a client’s data, privacy, and assets against cyberattacks. Meanwhile, only 48% claimed to invest in improving cybersecurity.

15. 3 out of 4 financial security leaders encountered one or more ransomware attacks in 2022.

(Insider Intelligence)

74% of financial security leaders reported being victims of one or more ransomware attacks, with 63% paying the ransom.

| 💡Did You Know? Many ransomware attacks exist, and one of the biggest ones is WannaCry. In 2017, it spread like an epidemic and held hostage the files and data of over 250,000 Microsoft Windows users across 150 countries, causing a $4 billion loss. |

16. 92% of ATMs are vulnerable to hackers.

(Positive Technologies)

The lack of hard drive encryption exposes 92% of ATMs to various attacks. A hacker can link to an ATM, deactivate security mechanisms, and control the cash dispenser.

Researchers also found that 85% of ATMs need better security against network attacks like spoofing the procession center.

17. $1 billion was lost from 100 banks in over 30 countries due to cyber theft in the past two years.

(Proofpoint)

A hacking group called “Carbanak Cybergang” is thought to be behind the attacks. To avoid suspicion, the gang confined the heist at each bank to $10 million.

Most compromised banks were Russian, but 30 other nations, including Japan, Europe, and the US, were affected.

| 💡Did You Know? Carbanak leader was arrested in Spain in 2018. Europol reported that the arrest resulted from a solid investigation with the help of different authorities. The attackers initially planned to target over 100 financial institutions across 40 countries. |

18. Banks and other financial businesses are the targets of 25% of all malware attacks.

(Forbes)

More malware attacks hit banks and other financial services companies than any other industry. Compromised credit cards increased by 212%, credential leaks by 129%, and malicious software by 102%.

Phishing Statistics

Phishing is a growing threat and becoming more widespread every year. With nearly 145 billion spam emails sent daily in 2021, it is the most common form of cybercrime.

In this last section, you’ll learn the examination of phishing data on the global economy:

19. Email is used in 96% of phishing attacks.

(Verizon)

Email is the primary method of delivery for 96% of phishing attacks. Just 1% are committed by phone, while another 3% happen on malicious websites.

| ✅Pro Tip: An anti-phishing add-on on your browser would be wise. Most browsers, if not all, enable you to install add-ons that spot the signs of a malicious website. They are also typically free. |

20. 97% of people are unable to identify a sophisticated phishing email.

(BusinessWire)

Only 3% of the roughly 19,000 survey participants from 144 countries could correctly identify every example, and 80% of participants got at least one of the phishing emails wrong.

| ✅Pro Tip: Phishing emails are usually from the public domain. For example, an email address that reads ‘[email protected].’ At first glance, it seems legitimate. However, you should take note that the essential part of the email address is what comes after the @ symbol. It indicates the org from which the email has been sent. If the email is from ‘@gmail.com’ or a different public domain, you can be certain it comes from a personal account. |

21. FBI recorded 241,342 victims filing phishing complaints.

(FBI)

With 241,342 victims filing complaints, phishing was the most common cybercrime reported to the FBI in 2020.

Here are the top five reported crime types for 2020:

22. 26% of Americans have been exposed to email phishing attempts.

(AICPA)

Three in five (60%) of US adults report that they or a family member have been victimized by a scheme, including:

- Fraudulent IRS letter, email, or telephone: 34%

- Credit card number theft: 28%

- Phishing emails: 28%

- Fraudulent disaster relief solicitation: 18%

- Opening new credit: 11%

- Pyramid scheme: 10%

- Tax refund claim: 6%

23. The average amount lost per phishing attack is $136.

(SurfShark, GetAstra)

Phishing victims lost $136 on average, totaling $44.2 million taken by cyber criminals through phishing attacks in 2021. According to GetAstra, statistics also suggest that over 1.2% of emails are malicious. It is equivalent to 3.4 billion phishing emails daily.

24. 45% of users were exposed to phishing links on their mobile devices.

(Security)

Attackers often use phishing links to send malware to a device that can stay on the device for a long time and continue to steal data.

Wrap-up

Online banking is a convenient and safe way to store money. However, the statistics in this blog show that you should be cautious due to the prevalence of online bank fraud and growing cybercrime in the banking industry.

Consider establishing a more secure way to access your bank accounts online using secure passwords and network connections.

FAQs on Account Takeover Fraud

How do I recognize phishing emails?

Phishing emails are almost impossible to recognize. However, some visual signs might help, such as poor grammar, unusual sense of urgency, instruction to send money, etc.

What do I do if my bank account has been hacked?

Contact your bank or card issuer. If funds have been withdrawn, they will secure your account and prevent further withdrawals.

Can I get my money back after getting hacked?

Yes, your bank must refund any money taken from you due to fraud and identity theft.

Sources:

- Juniper Research

- Astra Security

- Accenture

- PWC

- Chase Media Center

- Pew Research Center

- Last Pass

- Zippia

- Statista

- Pew Research Center

- Statista

- FBI

- Sophos Cyber Security

- CSO

- Security.org

- Veriff

- Feedzai

- BCG

- KMPG

- Insider Intelligence

- Positive Technologies

- NCR

- Proof Point

- 2-spyware

- Forbes

- Verizon

- BusinessWire

- FBI

- AICPA

- SurfShark

Leave a Reply