Cash vs Credit Card Spending Statistics

While still commonly used, cash is slowly giving way to credit cards and other digital payment methods. To keep track of this trend, we made a list of the most essential cash vs credit card spending statistics. Usage of cash in the United States, for example, dropped between 2016 and 2020, with the trend exacerbated by the COVID-19 pandemic. Americans mostly use this method for small purchases, while credit cards are the top choice for online shopping. Spending less money is the main benefit of using cash, while cards are more convenient and considered a safer choice during the pandemic.

Cash vs Credit Card Spending Statistics (Editor’s Choice)

- Cash accounts for 78.8% of all transaction volume in Europe.

- Spanish consumers prefer cash over credit cards.

- 29% of in-person payments are paid in cash.

- Cash usage fell from 31% in 2016 to 20% in 2021.

- 34% of Americans consider cash the safest payment method.

- Americans over 65 prefer to pay cash for everything.

Global Credit Card vs Cash Statistics

1. Cash represents over 50% of all payments worldwide.

According to the latest data on cash vs credit card spending, over 50% of payments are cash purchases. Spain, Cyprus, Greece, and Austria rank among the nations where cash payments represent over 80% of all transactions. The same study established that about 78.8% of all transactions in volume in Europe are cash payments.

(Cash Essentials)

2. Canada had the highest share of individuals with credit cards in 2021.

In 2021, 82.74% of Canadians responded to own at least one such card, as shown by credit card usage statistics by country. About 79.05% of adults in Israel held credit cards, meaning they scored second place. Iceland was the third country with the highest share of individuals with credit cards at 74%. The share of adults in the USA with at least one credit card in 2021 was 66.7%. This percentage placed the country at ninth place. South Sudan, Pakistan, and Cambodia were countries with a low rate of individuals that own credit cards, with only 0.15%, 0.22%, and 0.24% using this payment method, respectively.

(Statista)

3. In 2018, Spain was the country with the highest share of cash payments.

Cash usage statistics indicate that about 87% of payments in Spain in 2018 were made in cash. In Italy, the percentage was a bit lower (86%). It’s interesting to note that Japan earned the third spot here, as well. Of all payments in the country, 82% were paid in cash, despite the high share of Japanese individuals with credit cards. Other countries where banknotes dominated the cash to credit card sales ratio include Germany (80%), France (68%), and the UK (42%). South Korea and Sweden, in contrast, noted a low share of cash payments — 14% and 20%.

(Statista)

4. Cash use in developed countries dropped significantly between 2006 and 2016.

Payment method statistics show that cash use has been losing popularity in the most developed countries. An IMF study focused on 11 nations pointed to a 10-year average decrease of 20% — from 49% to 29%. In China, cash use in 2006 was 54%, dropping to 18% in 2016. Singapore noted an even more serious fall — from 61% to 30%. In 2006, the cash use level in Japan stood at 64%, only to fall to 23% in 2016. The same negative trend was seen in many other countries, including Australia, the UK, the US, Denmark, and Norway.

(IMF)

US Credit Card vs Cash Statistics

5. Cash usage dropped by 6% between 2019 and 2021.

The Federal Reserve’s latest research on payments uncovered that cash is losing popularity among American consumers. In 2016 and 2017, 31% of all payments were made with paper money. In 2018 and 2019, the share of this payment method dropped by 5% to 26%. In 2020, cash payments receded further, dropping to 19%, only to rise slightly to 20% in 2021.

Credit card usage meanwhile noted a rise in popularity. In 2016, about 18% of all payments were made with a credit card. Its market share kept rising to reach 28% in 2021.. According to the latest payment method statistics, 29% of transactions in 2021, were made with a debit card. So, while all eyes are on cash vs credit card spending, it’s debit cards that dominate the US market.

(Federal Reserve)

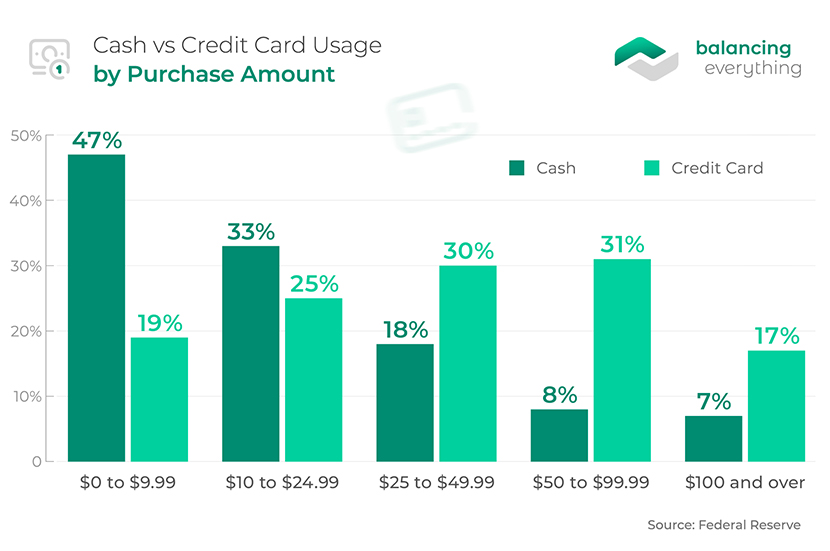

6. Cash is the most used for payments of up to $24.99.

About 47% of transactions between $0 and $9.99 are made in cash. This method is popular for payments from $10 to $24.99 (33%). As the purchase amount increases, cash usage drops. Only 18%, 8%, and 7% of payments $25–49.99, $50–99.99, and $100 or over were made with cash. Credit cards are the most used for purchases from $25 to $99.99. For larger purchases ($100+), most Americans (36%) use electronic payment methods. So, the use of cash vs credit cards or cash vs electronic payments depends on the amount.

(Federal Reserve)

7. Debit cards remain the preferred payment method for most Americans.

Debit card statistics show that Americans still prefer this type of payment, even if it inched lower in popularity between 2019 and 2021, from 30% to 29%. Credit card payments saw their popularity increase during the same period, while cash popularity dropped. In 2017, 29% of Americans said they prefer paying with a credit card. In 2021, this share jumped to 32%, staying only marginally behind debit cards.

(Federal Reserve)

8. Debit cards are the most common backup payment method among Americans who prefer cash payments.

The latest debit card statistics reveal that Americans who prefer cash use debit cards as a backup payment method. The situation is similar among consumers who tend to make debit card payments. When this isn’t an option, they usually pay with cash. Americans who prefer credit card purchases, however, find paper money to be the best alternative when choosing between cash vs debit.

(Federal Reserve)

9. Cards have dethroned cash as the most used in-person payment method.

In 2020, 29% of all in-person payments were made with cash, while debit cards accounted for 32%. Credit cards were the third most popular option, with 30%. Cash vs credit card spending statistics show these figures have changed little in 2021. The result is that 30% of in-person payments were made with a debit card, followed by 32% for credit cards, leaving cash in the third position with 29%.

(Federal Reserve)

10. Americans make most cash payments for food and personal care supplies.

On average, US consumers make five cash payments a month to purchase food and personal care supplies. In this category, therefore, the first wins the cash vs credit card battle. US consumers make one banknotes payment in most other categories, including general merchandise, personal services, and entertainment. Most payments in the United States for goods and services are made using cash if the total amount is low. Otherwise, Americans reach for their credit cards.

When it comes to housing-related purchases, the average number of cash transactions a month is zero. In this category, credit card payments lead the way with four transactions per month, according to credit card spending statistics.

(Federal Reserve)

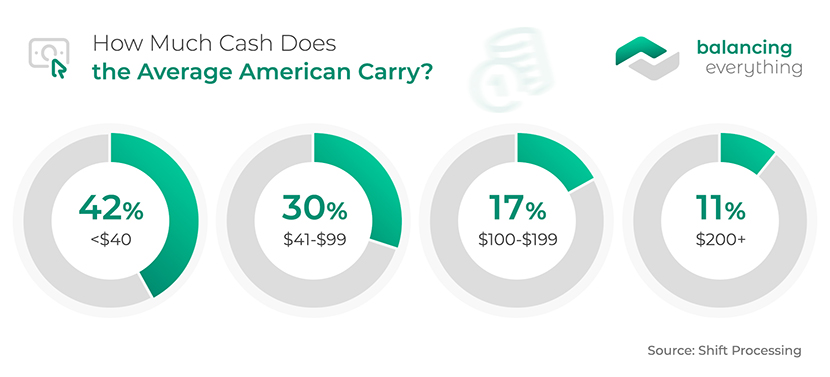

11. Most Americans carry under $40 in cash.

US consumers use cash for small purchases. Hence, it makes sense that 42% of Americans carry less than $40 on average. About 30% carry $41–99, and 17% of consumers hold $100–199 in cash.

(Shift Processing)

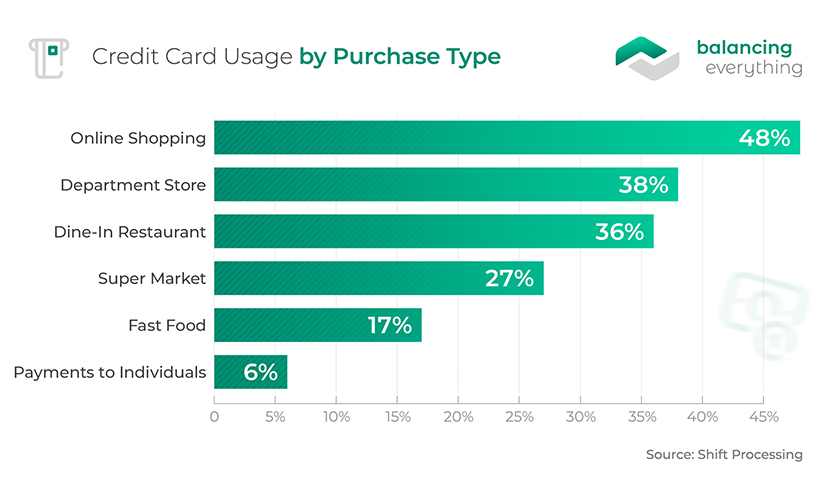

12. Americans use credit cards for online shopping the most.

When asked when they use credit cards the most, most US consumers (48%) answered with ‘online shopping.’ The latest credit card statistics also show that department store purchases and dine-in payments are often made with cards. About 38% and 36%, respectively, claimed to use credit cards for such transactions.

Only 27% and 17% of the survey participants said they use credit cards in supermarkets and to buy fast food. Credit cards are the least popular option (6%) for making payments to individuals. For such transfers, Americans prefer P2P options like PayPal and Venmo. About 14% of Americans use the latter for P2P transactions, according to the latest Venmo statistics.

(Shift Processing)

13. Consumers claim that using cash results in spending less money.

People spend about 83% more when they use credit cards, as suggested by cash vs credit card spending statistics. The average cash purchase in the US is $22. Credit and debit card purchases, by contrast, are $112. Experts explain that spending through your card doesn’t always seem like you’re spending real money. That’s why consumers find it easier to spend larger amounts with credit cards.

(Shift Processing)

14. 10% of American consumers have already loaded their credit cards into a mobile wallet.

With the rise of mobile wallets, Americans don’t even need their cards to use them. Credit card usage statistics indicate that about 10% of consumers have their cards into a mobile device or wallet. Respective 8% and 19% said they would ‘definitely’ and ‘likely’ load it soon. Still, nearly one-fourth of the respondents (24%) said they would never load their cards into their smartphones.

(TSYS)

15. Over a third of consumers believe that cash is the most secure payment method.

When asked about the safest purchase method, 34% of Americans chose cash. For 29% of the respondents, debit cards were the most secure option. This is based on the fact that even when stolen, debit cards can’t generate debt. The TSYS payment method stats show that only 27% of consumers found credit card spending the safest option. After all, the latest US identity theft statistics show that credit card fraud is the most common type of ID theft.

(TSYS)

16. Households making over $150,000 prefer credit card payments over cash and debit card transactions.

About 55% of these households prefer credit cards, while 30% and 6% prefer debit cards and cash. In most of the other income groups, debit cards are the preferred method of payment, while credit cards come next. Only in households with income under $25,000, about 21% prefer cash payments when choosing between cash vs credit vs debit. That’s slightly higher than the 18% of households that prefer credit cards.

(TSYS)

17. In 2018, most Americans owned two or more cards.

About 63% of US consumers had at least two credit cards in 2018, according to credit card statistics. Then, 28% and 16% held two and three cards, while 19% owned at least four credit cards. A bit over one-third (37%) of Americans had only one credit card. The situation is different when it comes to debit cards. In this category, just under 70% (69%) of consumers held a single debit card. The rest 25%, 5%, and 1% owned two, three, or over four debit cards, respectively.

(TSYS)

18. Most Americans use credit cards and electronic payment methods for church donations.

Our church giving statistics show that credit cards and electronic methods are preferred by 49% of people who donate money. About 40% selected cash as the most used and convenient method of donating money to churches. This is among the most interesting credit card spending statistics. Why? Well, Americans prefer the method for large purchases and expensive services. Church donations fall in neither of the categories. Checks were another common option mentioned by church donors, but it was significantly less popular as only 7% prefer such donations.

(Share Faith)

19. Both women and men prefer credit card donations over cash donations.

Women have slightly higher preferences of donating using credit cards — 54% compared to the 52% of men. According to the latest charitable giving statistics and facts, only 10% of female donors choose cash between cash vs card donations. This donation method is a bit more prevalent among male charity donors, as 12% of them prefer it.

(Giving USA)

Cash vs Credit Card Spending Statistics by Age

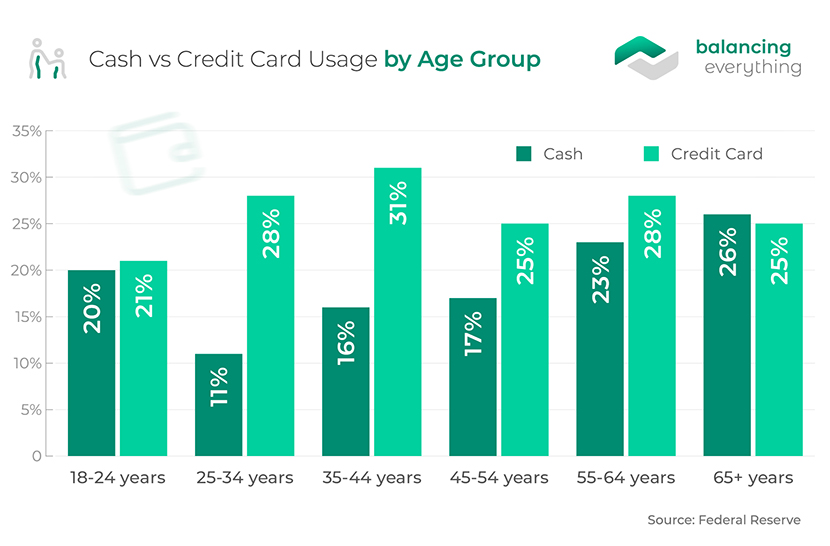

20. Americans aged 18–24 started using much less cash amid the pandemic.

While about a third of consumers from this age group preferred cash in 2019, only a fifth did so in 2020. Debit cards instead won over as many as 51% of Americans between 18 and 24. Just over a fifth (21%) of people aged 18–24 picked credit cards as a preferred payment method.

(Federal Reserve)

21. Cash payments are the least popular among US consumers aged 25–34.

Only 11% of these people consider cash as the best payment method. In this age category, debit cards are the most popular means of purchasing. About 33% of consumers picked them as their preferred payment method, according to credit card vs cash statistics. Credit cards come in between cash and debit cards, as 28% of Americans aged 25–34 prefer them for payments.

(Federal Reserve)

22. Cash has lost steam as a payment method among senior Americans.

Respective 23% and 26% of consumers 55–64 and 65+ opted for cash as their first choice for making payments as of 2020, down from 33% and 32% in the previous year. In the first age group, credit cards are the most common alternative (28%), and debit cards come in next (26%). Credit card usage statistics show that credit cards (25%) are the second choice for the 65+ age group, which is the only one where cash is the most preferred method. Debit cards come in third with 19%.

(Federal Reserve)

23. Americans between 35 and 44 years use credit cards the most.

In the age group 35–44, 29% prefer debit cards, while 31% and 16% choose credit cards and cash. Among US residents aged 45–54, 33% favor debit card payments. About 17% of consumers in the age group prefer paying with cash, while 25% said the same for credit cards.

(Federal Reserve)

24. Americans held a daily average of $67 in cash in 2021.

Cash usage statistics show that the average amount of cash held per day in the US was $67 in 2021. This was higher than the amounts of between $57 and $60 reported between 2016 and 2029, but lower than the 2020 average of $74. Americans aged 65 or older carried the highest daily amount of cash at $101. US consumers between 25 and 34, in contrast, hold the lowest average amount of cash per day ($39).

(Federal Reserve)

Frequently Asked Questions

What percentage of transactions are done with cash?

In 2020, 19% of all payments in America were done with cash, according to payment method stats. This marks a notable drop from the 26% recorded in the previous year, as more Americans turned to cashless payments amid the COVID-19 pandemic.

Is debit the same as cash?

When you use a debit card, you use cash you already own. In that sense, debit cards are similar to using cash. Debit cards don’t earn you any rewards and never include interest fees or late payments charges.

Unlike paper money, however, you can use debit cards to make online payments. Plus, your debit card is protected with a PIN code, so it’s safer. These are the main differences when comparing cash vs debit card spending. There are no specific benefits of using cash instead of a debit card.

Are credit cards used more than cash?

Credit card vs cash stats show that cash is losing popularity compared to credit cards. About 19% of payments in 2020 were made using cash, and 27% were credit card transactions. The difference, however, is closer when compared to 2016 when 31% of all payments were in cash, as opposed to 18% with a credit card.

What percent of purchases are made with a credit card?

Federal Reserve data shows that 27% of all payments in 2020 were made with a credit card. In 2016, 2017, and 2018 credit cards accounted for 18%, 22%, and 23% of all payments. Credit cards are popular for purchases of $20–49.99 (30%), and $50–99.99 (31%).

The Bottom Line

With electronic payment methods and contactless cards, cash is slowly losing its throne as the most popular payment method worldwide. The latest cash vs credit card spending statistics point to a fall in cash use in the US, especially amid the ongoing pandemic which has fast-tracked the shift to cashless payments.

References: Cash Essentials, Statista, Statista, IMF, Federal Reserve, Federal Reserve, Federal Reserve, Shift Processing, TSYS, Share Faith, Giving USA

Leave a Reply